Check out our Top Rewards Cards to boost your points earning and travel more!

I was one of the self-deluded dupes who applied for first-round SBA Paycheck Protection Program (PPP) for my business through Chase. Many others that applied at the major banks were similarly disregarded by their bank, with no few to no status updates and never submitted to the SBA.

Chase Follies:

My business banking is with Chase so I figured that would smooth the process. As well, Chase had a large proportion of initial PPP funds to distribute. Many other banks wanted some form of an existing business relationship, while others were not set up for applications until later.

My Chase timeline is comically sad, read for your entertainment pleasure:

- 4/2 and subsequent days filled out the Chase interest form.

- 4/6 applied immediately after Chase opened applications.

- 4/7 midnight received a Chase application number.

- Intervening days attempts to contact Chase branch bankers, they were unable to get any information other than one day ‘there is still money’ to the next day ‘there is no money’.

- 4/17 announcement from Chase that the money is gone.

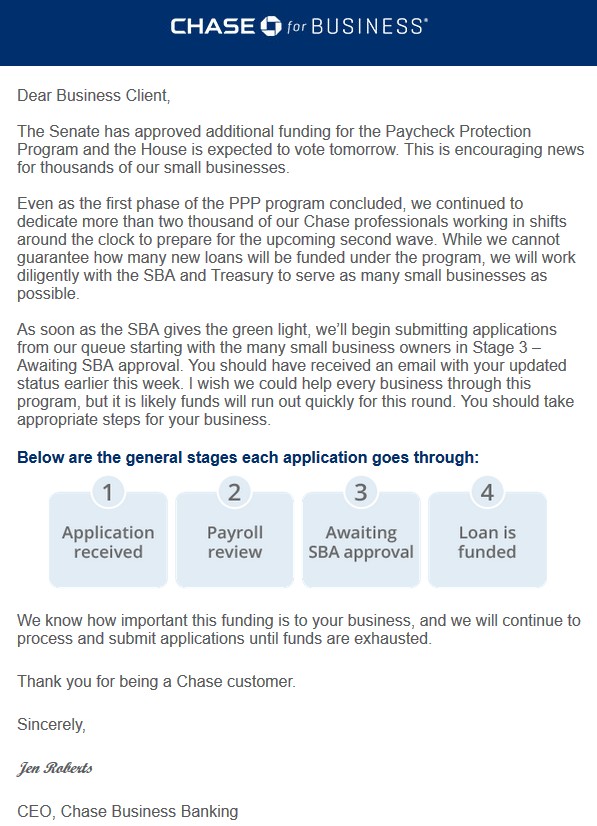

- 4/19 notice from Chase that my application has gone from Stage 1 ‘Application’ to Stage 2 ‘Payroll Review’.

- 4/22 announcement from Chase that if you are not in Stage 3 ‘Awaiting SBA Approval’ you better find a new bank, “As soon as the SBA gives the green light, we’ll begin submitting applications from our queue starting with the many small business owners in Stage 3 – Awaiting SBA approval. You should have received an email with your updated status earlier this week. I wish we could help every business through this program, but it is likely funds will run out quickly for this round. You should take appropriate steps for your business.”

- 4/23 notice from Chase that additional documentation is needed and I need to reapply, though I won’t lose my place in the queue.

- 4/25 notice from Chase that my re-application has been received.

- And nothing since.

Meanwhile, Chase is making chirpy announcements about how well they are serving their customers. Those that got front of the queue privileges.

Meanwhile, Chase is making chirpy announcements about how well they are serving their customers. Those that got front of the queue privileges.

Angry at Myself:

My anger was mainly directed at myself, not Chase. Everything I knew from miles and points I did not apply to PPP.

I foolishly trusted a major bank that doesn’t give a jot about my small business.

I did not connect the dots that the ‘first come, first serve’ was to how SBA would process applications it received from lenders and not any requirement (that I am aware) for the lenders to submit to the SBA based on when they received applications. Lenders moved the customers they value to the front of their submission queue.

I continued to wait on that bank without trying every alternative. I procrastinated on my taxes so I didn’t have all the potential documentation ready when the interim rule was announced by the SBA.

New Strategy:

I got my taxes ready (single-member LLC the key document is 2019 Schedule C).

I got my documentation in order. Check images, 1099s, bank statements (I found that Chase business checking doesn’t even provide an annual summary so I had to stitch together 12 months of statements).

I found this Forbes list of non-bank lenders accepting PPP applications and worked through the list.

BlueVine:

Turns out the first was the winner for me: BlueVine.

I had never heard of BlueVine. I won’t forget them.

My BlueVine timeline:

-

- 4/27 10:14 pm received email to activate my account and finish the application, which I did within 5 minutes.

- 4/27 10:34 pm received email that my application had been submitted to the SBA. I did not believe this. In less than 20 minutes BlueVine had reviewed my application and submitted to the SBA. Something Chase did not do for weeks.

- 4/28 9:27 pm received email that SBA had approved my loan, to log in to accept, which I did immediately.

- 4/28 9:34 pm received email with my DocuSign completed loan documents.

- 4/29 6:31 am received email that funds are on the way.

Today I shared with several business owners. One applied this morning and already is approved.

Other Reports:

I received one trusted report of success with Kabbage from 4/25.

Readers, contribute your data points.

Multiple Submissions?

My understanding of this process is that you are not beholden to wait on a lender that may never move on your application.

The limitation is one loan per business. If you are approved by one lender, then any subsequently approved need to be turned down. The SBA system might block multiple loan requests for the same EIN so I’m not sure multiple can event get approved for an EIN.

Good luck to fellow business owners!

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

I have to tell you, I am disgusted with Banks right now. There is no accountability. I had the same issue with Chase. We have banked with them for years. I did not have a copy of my tax return when I initially applied. So they rejected even though it said I could provide a P&L and a draft of my return. I got the return, unfortunately, there are no real people at Chase anymore, so there is no one to follow up with, and their rejection notice says specifically not to call as their representatives know nothing about the… Read more »

I applied around 5:00 CST and then uploaded my documents. I am now under review I am interested how they were able to complete your application at 10:30 at night since they close at 8:00 EST.?

@Kevin McArthur – my guess is either/both when they did the initial rush they worked around the clock or their back-office processing applications has longer hours than their customer service hours.

Hi,

Thanks for sharing your experience. I have a quick question. What if you submitted your schedule c to bluevine and forgot to put the code that goes in box B? For some reason that 5 digit didnt stick and ive been in review for two days where as people are saying they obtained a promissory notes within this time. Should I call in or give it more time?

@Jessica Amber – I would call. You could also try re-submitting in case there was an error on the form that is now fixed. Even if you get approved twice, as long as you just accept once you are fine.

Okay so now im at day 3 still under review After uploading my schedule c. I understand now at this point because a lot of people are applying legally and illegally how long was the wait until you’ve obtained Youre promissory note?

@Jessica Amber – mine was within hours, perhaps a different process now as you say. Be active contacting them.

Just signed my docs. Did everything you said youre awesome. Reply your cashapp tag want to send a token of appreciation because you didnt have to help me.

@Jessica Amber – that is gracious of you, thank you. $StefanKrasowski. I use Cash App for the great 10% off grocery store boosts they have had almost every week since May.

7/13. Applied with Bluevine

7/14 tried to reach them, waited on call back

7/15 9:30a recvd call back advised need clearer copy

11:30a. Sent another copy

12:45p email submitted to SBA

12:50p email offer recvd

1:30p no email but checked app, loan approved and the What’s next portion says a deposit will be made in the account

How long does this usually take?

@Virgina – 2-3 business days. Congrats!

Thanks, still waiting.

Is there any other funding avail besides Eidl

I enjoyed reading your PPP experience. Mine was similar, but with WF, beginning with an “expression of interest” 10 minutes after they opened their portal on April 4 and allowed to submit an application a week later. But nothing afterwards, except a letter saying that my application was conditionally approved, pending verification of additional information and asking that I sign a promissory note, but there was no promissory note. That made me think that WF had gotten SBA approval, especially when my other pending applications (bluevine and others) started reporting that my application had failed due to an existing SBA… Read more »

Hi Stefan

Thank you for all of your helpful information. I received the loan docs and signed on Sat from Blue Vine and this morning got an email saying the ACH deposit has been initiated into my account. How long did it take after you received that email to see the deposit in your account?

Thank you

@Kati – Congrats! I saw it pending in my bank account by the next business day and my bank posted the day after.

Great thank you so much 🙂

I am still kinda in shock that I was approved so quickly when I hear others waiting for weeks. Guess I’m just making sure it’s real.

I didn’t hear from Blue vine in 2 weeks finally got through to them and they said they would expedite my application to SBA. My application was submitted to SBA over a week ago and I still haven’t heard anything from Blue Vine. I think they are just pushing the small loans to the side because they aren’t with it for them

@Tom – mine was pretty small. In any case, everyone’s experience with these companies is different and best practice is to submit to several. Some I heard right away, some weeks later asking for more info and hadn’t really done anything. No consistent experience for anyone.

Stefan, I applied for PPP with BlueVine on 4/27 as well. All documents loaded. Said waiting for review. 17 days later my status reads the same. I’m self-employed, not seeking a large loan, any advice on how to find out any more information? Glad it worked well for you. I’m afraid I’m lost in the shuffle somewhere.

@Alli – people are having wildly varying experiences with each company, my suggestion is apply via a few more from the list while there is still time, then try to find a way to sort out BlueVine.

Will do, thanks!

Alli,, I also applied for ppp with Bluevine around the same time , Loaded all documents and as of today May 18th Mine kkall still say pending review…. I have heard you have to call them that it could be missing documents or incorrect documents, I have also heard that everybody with a loan less than 10k is all saying pending review… I will be calling them tommorow to see if i have any luck. Wish you best of luck!

We applied with WF before they shut down submissions around April 7. Then they opened back up and we got our package in April 15th, right before they ran out of money, uploading signature pages. I contacted banker a week later and he said our package had gone to SBA and was a good sign but no word from them except their constant messages that say “we are working on it.” April 23 I noticed that American Express was doing PPP loans when I logged in. We applied through them and the number on the application was 9000 something. The… Read more »

@anon – glad to hear you found success with the alternate.

CHASE lied all the time through my PPP application . I applied on 6th April and no help at all. Finally got an email saying got to re apply again but kicked back message while re apply we are not taking any application now. Bull shit. I will never do business with CHASE AGAIN. Very disappointing with their management and the entire team.

I applied to kabbage friday 5/1 after being ignored from Bank of america (where i have personal, business, and credit accounts) for over 2 weeks since submitting to them. I received an email sunday 5/3 at 8pm saying i was approved from kabbage. It told me to log in to sign the docs, but when I log in there are no docs. will be following up with them tomorrow, but so far they look good!

Any updates?? Same here but can’t get through to anyone at their number.

Any updates

[…] Stefan, of Rapid Travel Chai, blogs about his own experience: SBA PPP Woes? Try These Lenders. I Got Approved in a Day After Chase Kicked Me to the Curb. […]

yes…Bluevine helped approved my PPP loan in less than 24 hours, while my BofA didn’t give a Shit about small business owner like. Thanks for your Posting…I am so glad I read Boardingarea everyday.

@giowong – glad to hear of a fellow success story.

Curios – what does this cover? How many employees do you have for your business? Isn’t it minimum 2 employees full time?

@Maxraxstax – I’ve seen no such requirement. Self-employed are eligible.

Do you have yourself on payroll? How do you qualify for ppp otherwise? What’s the payroll part?

@Maxraxstax – yes, and SBA Interim Rule accepts Schedule C and related income (1099s, checks, etc) and payroll/banking documentation as acceptable.

So it’s Chase’s fault that you didn’t beat the odds? They have received some 300,000 applications but the SBA has limited their approvals to roughly 30,000 so only 1 in 10 are getting approved for them and other large banks. Small banks are getting equal space at the SBA window so you have better odds. You have no proof Chase prioritized their clients’ applications other than maybe rewarding those that provided the requested documentation more timely. You’re just mad you didn’t get the free money. Go ahead and stop doing business with Chase – stop taking their credit cards –… Read more »

@TiredOfTheWhining – go ahead and read the post and you’ll see I blamed myself.

I did read it. Here’s the first paragraph, “ I was one of the dupes who applied for first-round SBA Paycheck Protection Program (PPP) for my business through Chase. Many others that applied at the major banks were similarly disregarded by their bank.” Add, “ Lenders moved the customers they value to the front of their submission queue.”. That’s you blaming them, not yourself.

@TiredofTheWhining – I did not blame them for how they ran their queue. A bank maximizing shareholder value would handle it most likely how they did. I am not a valuable client and I say I am one of the dupes because I took the government statements about the program and deceived myself into thinking ‘first come first served’ applied to the bank when it applied to the SBA. Chase never said my chances were good, never gave me anything to be encouraged, it was all my self-deception. The most helpful thing Chase did, albeit much later than would have… Read more »

How long have you worked at Chase? Please do some research, as this has NOTHING to do with odds – it’s now well known they absolutely DID prioritize applications based on larger loan/ fee size:

https://www.nytimes.com/2020/04/22/business/sba-loans-ppp-coronavirus.html

https://news.bloomberglaw.com/banking-law/banks-fast-tracked-large-ppp-loans-to-max-out-fees-suits-allege

https://www.reddit.com/r/smallbusiness/comments/g3bg5r/chases_average_ppp_loan_was_515304_proving_that/?utm_source=share&utm_medium=web2x

There are hundreds more articles about this if you care to find them.

Stefan, I was in the same boat with Bank of America. I applied within the first hour of the app going live on April 6. I have yet to hear anything from them even though I’m supposedly a “Platinum Rewards Small Business Client.” I applied through Intuit (where do I do my payroll) as soon as their app went live on Monday 4/27 but haven’t heard anything. I figured Intuit would be the fastest since they already have all of my payroll data! Now I’m going to try the other fintech companies too. Thanks for the tips!

Glad to read this! I used lendio who directed us to bluevine this am. We are now seeing the sent to sba message, though it took 6-12h from initial app to hit that. Fingers crossed. This is the most promising app we’ve seen and we’ve been on the run around, just as you. Single member LLC too.

I had the same experience with Chase for Round 1 (I love my Ultimate Rewards points!) and then turned around and filed with Lendio, who found BlueVine, and I was approved rather quickly at the start of Round 2. I also applied through Square Capital, but haven’t heard from them since my initial submission. So thumbs up for Blue Vine.

I put an application in with my local bank a week ago. The email I got back said I would have notice within 48-72 hours. I’ve had my checking account with this bank since 1979, and I’ve had 3 business accounts with them since 2005.I called a local branch today and she said she can’t tell me anything, and I may not know for a month! This is Citizens Bank, a substantial player in NE. I just tried to apply at Bluevine and the website won’t let me join. Same thing withe IRS letting me put in my bank info… Read more »

@Stephanie Woods – if one on the Forbes list doesn’t work for you, try another. They each have different requirements. Try Kabbage next

I applied last night via Kabbage after also having issues with BlueVine’s website. Was just approved by Kabbage (less than 24 hours after submitting my app). Thank you!

Hi Stefan, did you receive money in the Bank yet from BlueVine?

@Mike – yes, showing pending yesterday and posted today.

That’s awesome and very reassuring. Thanks!