Check out our Top Rewards Cards to boost your points earning and travel more!

While Britain votes itself into irrelevance after several centuries at the center of global affairs, us in our little travel hobby are working the angles as usual.

@foofiter its very hard for end consumers to take advantage of swings like this. a lot of consumers products are not doing f/x rate in RT

— The Flight Deal (@TheFlightDeal) June 24, 2016

The question is can we take advantage of the tanking British Pound (GBP) to save on airfare? (or prepaid travel such as hotels, train tickets, etc.)

You’ve got general airfares priced in GBP from British sales channels, and then you have airfares for trips departing from the UK that have fixed GBP rates for Air Passenger Duty (ADP) built in. A prepaid hotel is, well, a prepaid hotel. Or you can exchange cash for GBP and have flexibility.

As The Flight Deal alludes, it is not necessarily the exchange rate you are seeing online that you will be charged. Each credit card processor has their own methodology, which may not be real-time. There are much debated and tested. When View from the Wing posted on this topic, reader PrivU contributed this interpretation:

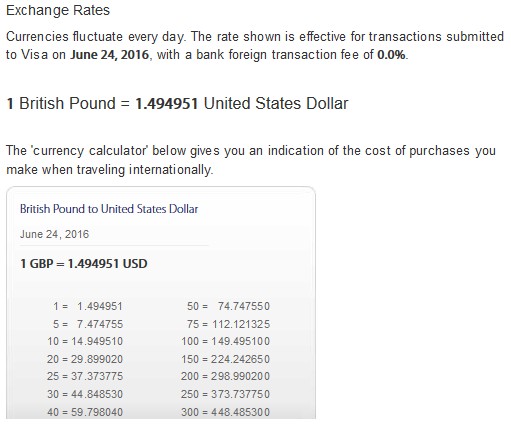

MileValue followed up sharing links to the MasterCard Currency Conversion Tool and Visa Exchange Rates (Amex rates not publicly available).

If the information from PrivU is correct, then in the case of a rapidly changing currency, you may want to use a Visa card to lock in a rate the day of transaction, even if taking a 1% haircut. Arguing the opposite is Doctor of Credit, saying Visa is settlement day like MasterCard. The language does seem ambiguous and if you hunt around forums like Flyer Talk you get all kinds of theories and tests. The safest is to assume all will be date the transaction posts which is a lag from transaction date.

If you book a ticket that you have a grace period to cancel, you should then be able to see the final Visa rate you will get in your credit card pending charges, while with MasterCard it could shift over the days it takes to post the transaction. You could outsmart yourself, because the way the merchant handles the grace period cancel might bite you. For instance, if instead of voiding the charge, they charge you, then several days later refund you, you might lose out if the rate has dropped further.

Currency markets are rough patches for individual consumers to play and risk can quickly escalate. If the rate is favorable and I have transactions that I would otherwise make at high rates, I may lock them in. Otherwise, I would only want to keep things flexible in cash. Realistically, in the amounts most of us consumers would play in, those with huge GBP expenses excepted, the potential gain for a trip or two is not enough to take big risks.

Readers, what’s your play for the Brexit GBP plunge?

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram