Check out our Top Rewards Cards to boost your points earning and travel more!

US taxpayers with foreign bank accounts go through an annual reporting ritual called Foreign Bank Account Reporting (FBAR).

Any United States person with at least one foreign bank account, and cumulative value of all foreign bank accounts exceeded $10,000 at any time during the year, are required to file a FBAR.

In recent years this has been brought under the umbrella of Banking Secrecy Act (BSA) of 1970 and Financial Crimes Enforcement Network (FinCEN) created in 1990.

Headaches for Expats

The Foreign Account Tax Compliance Act of 2010 (FACTA) upped the bank account reporting requirements, becoming especially onerous for foreign banks to have US person account holders. Some foreign banks responded by terminating affected accounts and refusing to do business with US persons. You see periodic WSJ articles on US expats renouncing citizenship (and here and here) so they can have functional lives in some European countries that are going cashless.

My foreign bank accounts are in China where they are more adept at, or more courageous in, giving other country regulators the shove off.

My accounts from when I worked in China and no longer have $10,000. I figure it is better to keep reporting at the diminished amounts than stop and invite questions.

BSA E-Filing

The BSA E-Filing system has been an example of government bureaucracy fail. Paper submissions were phasing out while even in 2015 the online system only reliably worked with Internet Explorer and Adobe Acrobat. You had to go through a delicate dance using the right versions of both, used in the right sequence, and with the right security settings (disabled) in the hope everything would work. Oh, and to get a BSA E-Filing PIN along the way.

This year the traditional June 15 filing deadline has been moved up to tax filing day (April 18) with an automatic extension to October 15. Automatic extension sounds weird though is tied to similar extensions for those living overseas from back in the time when communications were much slower.

This announcement was December 16, 2016 (under Obama), along with an improved BSA E-Filing System.

New BSA E-Filing

The new BSA E-Filing process is fast and easy. Shocker!

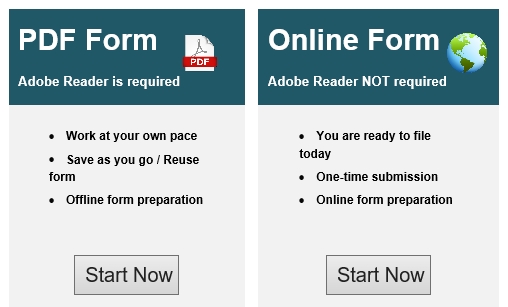

Now an individual filing FBAR no longer needs to register a BSA E-Filing account. There is a quick no registration PDF or online FBAR form option that can be done and submitted in a few minutes. Works in modern browsers!

My first time with the new process I was done in under 5 minutes. Under the old, I would have still been updating the passwords that constantly expire. I got a crisp download form and immediate email confirmation.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

The deadline was along with Tax date even last year. Online filing has been available for 3 years now. I am not sure if the “no registration” thing started last year or the year before though. https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar says ‘The new annual due date for filing Reports of Foreign Bank and Financial Accounts (FBAR) for foreign financial accounts is April 15. This date change was mandated by the Surface Transportation and Veterans Health Care Choice Improvement Act of 2015, Public Law 114-41 (the “Act”). Specifically, section 2006(b)(11) of the Act changes the FBAR due date to April 15 to coincide with… Read more »

I could have missed the ‘no registration’ the last few years been doing it the hard way with the regular BSA E-Filing system, which you can still use to file FBAR and is the only online option for some of the other report. Though this year it popped out and if it was that visible last year I hope I would have noticed it.

that’s good news, both on the deadlines and process…

now, if the US would just increase the balances for reporting and move to taxation based on residence like any other developed country, live would be a lot easier…