Check out our Top Rewards Cards to boost your points earning and travel more!

There is a new 100k offer, this time for the Amex Business Platinum. Take your pick of outlet touting this, I’ll choose Miles to Memories since it put a word of caution front and center.

This appears to be a public offer, not a leaked or targeted offer such as the 100k Platinum one that went viral in May.

That 100k offer apparently rankled at Amex which went on a witch hunt of customers to weasel out of the 100k. Some of their tactics, by the way all without proper communication:

- Freezing Membership Rewards accounts of those who transferred points out

- Waiting till day 91 of the 90-day $3,000 minimum spend period, then retracting the 100k points with no explanation, until a generic letter two weeks later

- Yanking the points from those who downgraded the card within a few months to minimize the out of pocket annual fee

The core effort was to indentify any purchases that violated fine print in the terms:

The following charges do NOT count towards the Threshold Amount: fees or interest charges; balance transfers; cash advances; purchases of travelers checks; purchases or reloading of prepaid cards; or purchases of other cash equivalents.

This was extended even to store gift card which are certainly not cash equivalents.

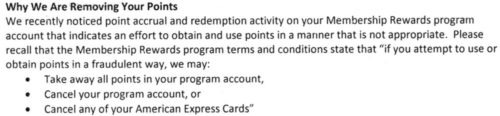

The thing is, they just took the points without notice or inquiry to validate the charges, then the generic letter weeks later, with no specific documentation, implied fraud, a strong legal term:

Whether people should know these fine print terms or not, or manufacture spend or not, is to me, beside the point. Amex never enforced such terms previously, and as far as we know, has not since for any other offers. They could not have handled this case worse in how they penalized and communicated to customers.

Will Amex enforce it for this new 100k? We don’t know if someone at Amex will get a bug up their butt about this one, too.

What I am curious is if people who got their prior 100k ripped from them can get the personal card again sometime and collect that bonus. Maybe they will get a nastygram saying they had the bonus before, even if they couldn’t keep it.

Related posts:

Saks Friends & Family Sale to 10/4/21 + TopCashBack 10% - Use Your Amex Platinum Saks $50 Credits

Delta Amex Card Changes Throw a Bone to Card Loyalists, Stiff Elite Status Chasers

Qantas Day: Adds Amex as a Transfer Partner, Sends Out Targeted 15-30% Transfer Bonus Offers

The Credit Cards in My Wallet, Travel Wallet, and Drawer [2019]

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

I got treated rather shabbily by AMEX recently and I’ve. Even a customer for some 43 years. They took my Delta personal Platinum fee along with the required spend and, after telling me I would get the bonus, later refused b/c some 5 YEARS AGO, I had the card. Like I’m supposed to remember that. Well why then didn’t you tell me that when I APPLIED? They had the information readily available. When I called I spoke to their recent graduate of Sweettalking University who promised to get back to me, which they didn’t and when I called they said… Read more »

Even if you play by the rules you will be harmed. They don’t state in their Terms about cancelling a card too early because your points were frozen using organic spend.

It’s clear that Amex is sending a direct message to the people that do a lot of MS and drop cards….they do not want or need your business, If a bank customer is doing MS all the time, the bank is losing money. Points are not free. The bank pays for them. Banks are not in business to lose money to MS customers, so Amex is meticulously throwing them out. If you want points, do your spend down organically and don’t dump the card to avoid paying the AF.

It’s pretty simple, don’t MS to meet bonus requirements and you want get slapped. No one that played by the clearly stated rules lost their points. True, some were frozen while it was sorted out but that’s more likely bc they had to weed out the MS’ers

i don’t like Amex and closed all cards with them after they took back 100K bonus this summer following my refund of a refundable fare. I found a lower fare for my route and refunded the original refundable fare to the Platinum card. I charged the new tickets to my Gold card. A week or two after the 3-month period for the 100K bonus ended I received PAPER letter in the mail that they deducted my points. They say in their T&C that nothing about returned merchandise not qualifying for the points. After they awarded the bonus and I got… Read more »

“What I am curious is if people who got their prior 100k ripped from them can get the personal card again sometime and collect that bonus.”

Unlikely. The language precludes ever having the CARD, not the BONUS.

Very happy to be wrong though.

Those of us who followed the rules (whether or not you think it’s “beside the point”, Amex disagrees) have no problem accessing our Membership Rewards. You can stomp your feet, pout, and say Amex is bad to its customers but be aware – YOU aren’t firing THEM.

@houstonRobert – I didn’t have one of the accounts by the way, but that doesn’t mean I don’t care for other how this was handed. Anyway, if you had ‘followed the rules’ I suppose you wouldn’t have used a link apparently not intended for you, so we quickly go down a rabbit hole. My point is that Amex’s handling was terrible. Accusing people of fraud? People made purchases with their card. If those are non-qualifying, Amex should never have awarded the bonus. By awarding the bonus, customers interpret that as it qualifying for the bonus. A normal customer can assume… Read more »

@Daniel. I received a targeted 100k offer in August, applied and was approved, met the minimum spend 100% organically (No MS), and then had my points posted and frozen immediately. I haven’t been able to access them since last month. All attempts to call and talk with a person about it have been rebuffed.

Just to be clear, even if you follow their rules, they’ll still find an excuse to screw you over.

Stefan, thanks for telling it like it is.

This is a business credit card, so if you put real spend on it then you shouldn’t have any problems. If you are buying gift cards, cash cards, money orders then you have no ability to spend so you are trying to game the system. This is not the kind of customer American Express wants. I had a great Starwood redemption on hold and American Express loaned me 100,000 StarPoints to complete the reservation, this is about 1.5 months of spend for us. But it was nice of them to do it and allowed me to confirm my booking. If… Read more »

well, to be fair,related to the personal platinum cc, people who didn’t get a targeted code from Amex should not have used it to apply at 1st place. If so, all of the pts claw back or acct cancellation would not have happened

@Daniel – that offer did not require a targeted code, it was a link that whether intended to be public or not, and a lot of people, even people who have never jumped on credit cards before, applied and were approved. Those of us in this hobby long-term can see there is some risk but people just seeing it shared by friends as a great deal had no reason to believe from any of the application process that it was anything but a great deal. I don’t recall there was even any fine print langauge about targeting. Different than say… Read more »

Great write up. I don’t usually comment, but this is spot on and honest. Need more posts like this. Thanks for telling it like it is.

Your title is great. It’s so true! Amex is a TERRIBLE company. They just don’t get it (or people who actually know how to use points). I got a 100k Amex Platinum 1 1/2 years ago. Long story, but I asked for my pending points to be advanced during the second month (nominal amount of points) and the manager literally accused me of fraud. I transferred my 110k points to BA the next morning, maxed out my airline credits that week and global entry credit and closed the account within 60 days and received my $450 back. I had been… Read more »