Check out our Top Rewards Cards to boost your points earning and travel more!

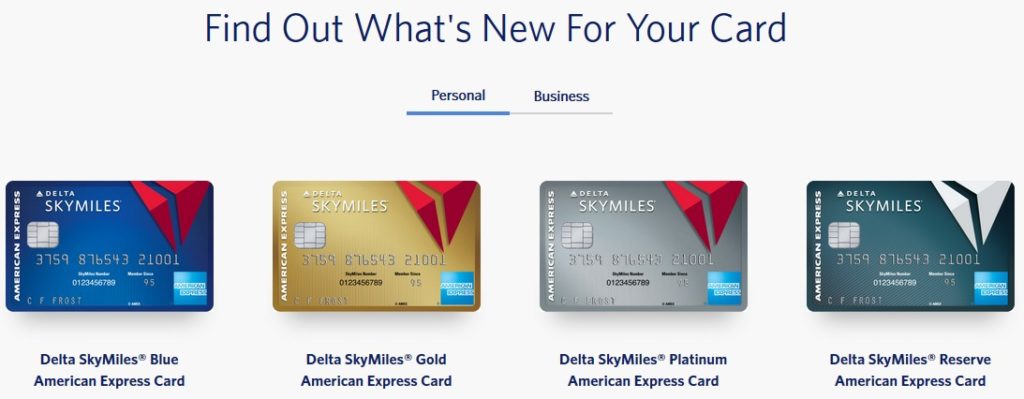

Delta has announced changes to its lineup of American Express cards, effective January 30, 2020. Visit the site NewDeltaAmex.com for the full details.

Delta has publicly stated that its credit card portfolio is key to its profitability, six months ago re-upping with Amex to 2029.

Grinding Customers:

Two themes I see in the changes are:

- Throw a bone to casual travelers that have kept using the Delta cards despite banks improving their own offerings (like the Chase Ultimate Rewards family of cards). Category bonuses on grocery stores and restaurants, even if not best in class, may extend cardmember loyalty for those not determined to maximize every reward and carry a bunch of cards. They may not recoup the difference in the annual fee increase, which will suit Delta fine.

- Test the limits of the obsession of elite status chasers. The Reserve and Platinum cards have annual spend targets to earn Medallion Qualification Miles, ‘MQM Boosts’. You earn miles for the initial spend, plus bonus redeemable miles along with MQMs in the Boost. Example: $30k spend on a Delta Reserve earns a minimum of 30k points along the way, then the boost earns 15k MQMs and 15k redeemable miles. Going forward, the boosts are rebranded as ‘Status Boosts’ that only award the MQMs, not the bonus redeemable miles.

Not having access to the numbers, I think Delta is probably right on both themes in terms of overall portfolio profitability. People who have the cards in their wallets will probably keep them. 3x on Delta purchases can keep them around, no need to offer 5x.

Status chasers will probably stay so addicted that they won’t stop and so Delta saves money by cutting the bonus miles portion of the boost. At the margins, the increased annual fees will lose some small number of customers.

My Quick Takes on the Cards:

Support the blog disclaimer: I have included refer-a-friend links for the cards, as many of these offers are excellent. That is the personal cards. The refer-a-friend on the business cards is currently terrible. With the annual fees increasing, this is a time to get the cards if they are on your list. I’ll be getting the Delta Reserve Business myself. If between my wife and I we don’t have one of the cards, on the refer-a-friend you’ll need to scroll to the bottom of the card page and select to see the other card offers. Thank you.

Frequent Miler already has a detailed analysis that I mostly concur. My first reaction was ‘not terrible.’ I am less positive after digesting it for a few hours.

Here are my quick takes:

Delta Blue: 2x on restaurants and dropping the foreign exchange fee. Will remain a good downgrade option from the annual fee cards.

Delta Gold personal: tweaks at the margins to cards that weren’t good to begin with, except for occasional travelers looking to save on checked bag fees.

Delta Gold business: tweaks at the margins to cards that weren’t good to begin with, except for occasional travelers looking to save on checked bag fees.

Delta Platinum personal: unjustified $55 annual fee increase to add a few, modest bonus categories. MQM Boost devaluation hurts. At that high of an annual fee, the annual companion economy certificate should drop the fare code restrictions that make it often difficult to use.

Delta Platinum business: 1.5x on miles for purchases of $5k or more, that partly offsets the MQM Boost devaluation for those that can spend in large chunks.

Delta Reserve personal: unjustified $100 annual fee increase. Stupid requirement to book with the card to get Centurion Lounge access (what about corporate travelers?). Up to 4 Status Boosts per year (requiring total $120k spend) will tempt people going for the $250k Diamond MQD waiver, though hurt to not earn bonus miles.

Delta Reserve business: 1.5x is only on purchases after spending $150k in a year, making it a loser on that score compared to the Platinum business.

Delta Sky Club agents: no love for the Delta Sky Club agents that every day have to explain to customers that a Delta Platinum card is not an Amex Platinum card of the type that grants Sky Club access. Delta could have taken the chance to change the name to reduce confusion and disappointment.

My 2020 Strategy:

This is the first year I took the bait on spending $250k to get the MQD waiver for Diamond Status. This is because (1) ego addiction to Diamond that I’ve held since the status launch, and (2) I had not had the Reserve cards before and wanted to collect each bonus.

With these changes, unless I hit the cards hard next January, I will close these down except one for the $25k MQD waiver and settle for Platinum status.

The annual companion certs are a pain to use because of the fare code restrictions. I recently had a Seattle-New York trip with my wife that I checked daily for a month. Every nonstop was excluded by fare code, even when connections with awful connections were the same or more expensive cash price.

Diamond status value to me has been severely downgraded this year by Delta selling upgrades out from under me for cheap.

Amex limits us to five of their credit cards (charge cards excluded). I’d rather use the slots for Hilton or Marriott cards for their anniversary certs.

What is your 2020 Delta credit card strategy?

Related posts:

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

I believe the “additional” Delta Reserve card that allows Sky Club access is only the one that has a $175 annual fee, not the additional card you can get for free that just adds spending to the DL Reserve account. This does not appear to have changed and I can’t find anything that says differently.

As far as I can tell, it was initially falsely reported by TPG that the ticket must be charged to a DL CC to permit Centurion access. The actual language is that it must be charged to any AX, which could include a corporate card. Likely reality is that this is AX just protecting their brand. I’d be quite surprised if lounge workers have the ability to view ticket purchase info. An actual DL employee could do that if they wanted to create a rule for SC entry. Wait, I shouldn’t give them any ideas. 🙂

@Carl – interesting and that makes sense (like companion certs). The TPG reporting and podcast interviews are softball questions, too, unfortunately.

May I ask how do you send $250,000 annually on this credit card? That’s a lot of clothes and shoes to buy!

@Shannon – this is the first, and likely last, year that I am doing that. I am not normally a big MS-er so this is a heavy lift. Amex doesn’t count Simon anymore so it is other gift card sources, account funding, (over)paying estimated income taxes.

Wow! You are the Taliban ( in a good way like destroyer) of credit card churning. Love it.

My plan for AMEX? The cards (all AMEX) are being sock drawered and their credit lines reduced to minimal amounts to avoid credit score hits when they get canned in 2020. My plan for Delta? It is no longer even considered for flight planning on international flights. AMEX and Delta have bonvoyed up with these recent changes – you can put lipstick on a pig, but it don’t make it pretty!

These changes are killing it for us. Dropping the Platinum now that bonus miles are going away. Will spend just enough on Gold to rebate the annual fee. The rest is going on an Everyday Preferred, which will earn me 35% more miles than the Platinum card used to.

The one positive change to the Reserve I haven’t seen discussed much is that “additional cards” now also grant Sky Club access. I’d kept the Amex Platinum charge card just so my wife could have the additional, cheaper card and still get club access. Now that it’s possible to do this with the Reserve, I’ll probably dump the charge card and bump up my Delta Platinum to the Reserve.

@Jay – I missed that, thank you for pointing that out. That might fit my wife’s situation as well. She doesn’t care for the SEA Centurion Lounge compatred to the Sky Club, and isn’t in the other Centurion airports or Escape Lounge airports enough to make a difference to her. She’s got Priority Pass via CNB that includes restaurants. We do well enough with the Charles Schwab Platinum after credit for investment balances, and the various airline/Uber/Saks credits that we haven’t put attention on alternate options.