Check out our Top Rewards Cards to boost your points earning and travel more!

The Citi Prestige card has held a steady online sign-up bonus of 30k, then I was alerted by FrequentMiler to a 60k in-branch offer.

This is a complicated card and many benefits change October 18, 2014, some eliminated immediately, some grandfathered over the course of a year, while some new benefits are added. See articles from MileCards, Dr. Credit Card and Hack My Trip to review the offers, card benefits and why now might be a good time to get the card.

There are reports that the 60k offer is intended for Citigold checking account holders. Last week I went to a branch to apply even though I have no banking relationship with Citi.

I waited it out through a full New Jersey experience, with a middle-aged women droning on and on about credit card late fees the branch could do nothing about, interspersed with her life story and frequent references to her dialysis treatment. Like other branches, the tellers can do nothing with new accounts and there was only one banker.

When I got to the Citi banker, her first question was if I had a Citigold or ‘Blue’ checking account. Nope. She went to the back, talked to the manager and I later learned she called an internal help line who recommend that she process the application as a ‘Global Customer’ rather than as a US person with SSN.

She came out, did the form on her system, I signed off, and she said it would be faxed in. Yes, faxed. Two days later I had heard nothing, Citi had not received any application, and I had to go back to the branch before leaving the country on business for two weeks.

The banker was there and she explain the ‘Global Customer’ approach had produced a request that I provided all kinds of information like an employer verification letter. Since they did not have my SSN, no credit report was pulled.

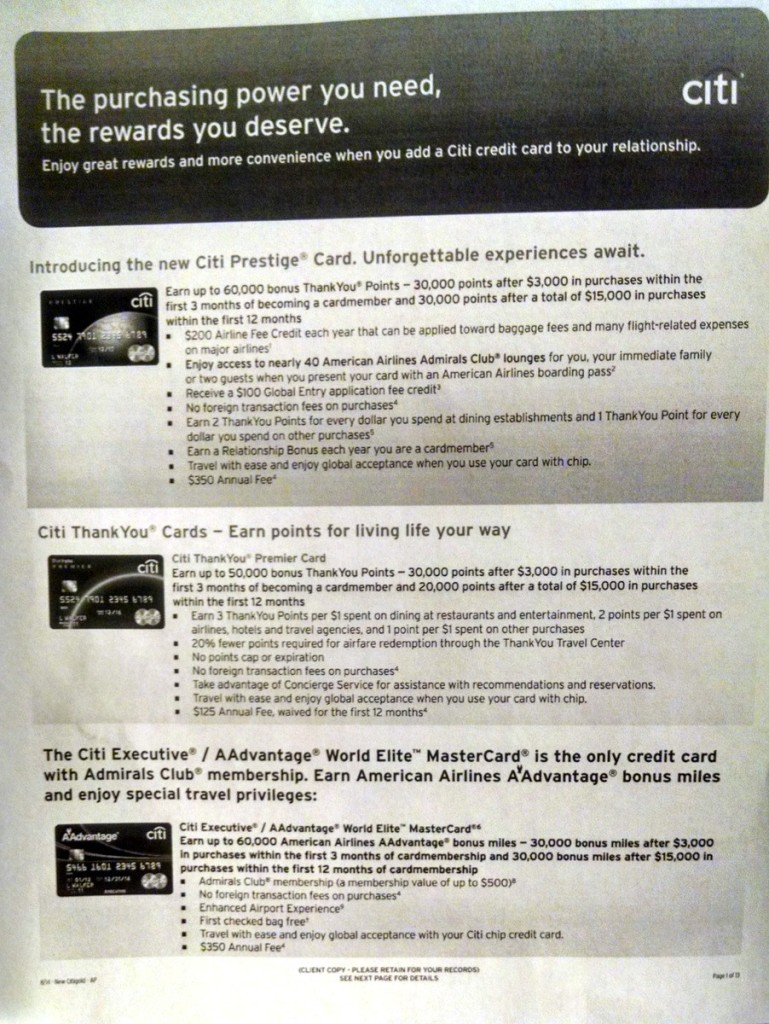

I asked to see the full offer and application details for US applicants and she printed out a stack of forms and fine print. Studying it over, the application did have two places to enter Citigold account number and one place to enter Citigold debit card account number, but nowhere did it explicitly say it was mandatory to provide an account number or to have an account to get the offer.

I asked the banker just to submit the application without account number. She was nervous that it would waste a credit inquiry, but I won her over and she agreed to send it in.

After the long weekend I called Citi’s public application status number (888-201-4523) and the agent gave me a reference number but could not connect me with someone to immediately process the application. From the website citicards.com I was then able to enter the reference number to check application status and was given a message to call a different number (800-695-5171, or try 800-950-5114) for immediate processing. I did so, the agent put me on hold, and came back a few minutes to approve my card with no questions other than to add a mobile phone number, similar to other recent apps. She confirmed the 60k bonus offer. Yay! (Note: I forgot to confirm with her if I will also get the lower annual fee that Citigold account holders get, we’ll see).

Takeaway: the Citi Prestige in-branch 60k offer is open to all. Find a banker who will play ball, leave the Citigold account number blank, and have them submit the application.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

[…] Best Offer: There is a public 50,000 point offer after $3k in spend the first three months. You can find out more about the in-branch 60k offer here. […]

[…] reports of being able to get this offer in branch without having a Citigold account (here and here) and after my experience, I agree this to be true though in my example, it is highly dependent on […]

[…] a lot of people have had success getting it without having this account open (for example, Rapid Travel Chai, GrnLantern & linglingfool [although he has had it in the […]

[…] is a deal-breaker for me, but I thought I would mention it. See this post for more. Also, Doctor of Credit blog reports that some were able to get an offer of 50,000 points […]

[…] bonus points or the like for a card that costs $450 a year, you’re better off with a Prestige where you can bump the bonus to 60,000 points and get improved lounge benefits along with a superior airline fee […]

[…] called up Citi and told them that a friend of mine had signed up for the 60K offer (which is true, see this post), and I asked if I could be bumped up to that offer. The agent on the phone couldn’t help […]

I also submitted my citi application for the 60k bonus & $350 AF w/o Citigold at a local Citi Branch in Los Angeles. Approved and got the card yesterday..

Quick question…if we do close the citigold account after year 1, does the fee revert back to 450? Thx.

@HD – I have not seen reports on that. In my case I got the $350 without even having a CitiGold account so will be curious what happens next year.

I applied today at the bank branch for the 60K/$350 AF. Would only give me the $350 AF if I had Citigold. So I xfered in $50K (happened to have some spare cash I was moving) to get the lower AF. As soon as I get approved I’ll move out the cash and close the Citigold account. Citigold is worthless and it seems it’s a dividing line for those who they will target with sales pitches (they will contact you “periodically” to see if you need help with financial issues). I guess above $50K you’re a big enough sucker to… Read more »

@Paul – yes, my short career with in-branch offers is over unless something stupendous appears. Fortunately my branch submitted my application without any checking account info and, Citi being Citi, it went through and I’ve got the card terms proving it will only be $350.

[…] I went ahead and applied for the Prestige card despite the $450 annual fee. As a reminder, Rapid Travel Chai found that it is possible to sign up for the card with a $350 annual fee if you si…. With no Citi branches near me, I resigned myself to the larger fee in exchange for the ease of […]

Flights booked before 19 oct accrue flight points even if flights occur after the changeover…

j – I wish I had more trips confirmed that I could book in time.

[…] recently got the Citi Prestige card through the in-branch 60k offer. It is a complicated card of many benefits, a number of which are changing October 19, 2014, […]

So the important question, are you going to try to game the system with refundable tickets to get flight points? Is this even possible anymore?

@j – I am a bit late for that, from what I see the post-Oct 19 card benefits are not as good in that respect, though do have 3x on airfare so may be attractive for some compared to alternative cards.

[…] Travel Chai recently spent a fun filled day in New Jersey signing up for credit cards in-branch (read his post here). His prime target was the Citi Prestige 60K offer. He had learned about the offer from […]

@Joey – those without a qualifying banking relationship pay $450. There is a bunch of fine print that is sitting in NYC and I am in BOM so will have to double-check the fee language from my offer, as I recall that part (and not the sign-up bonus) did specifically require a Citigold account. Then we’ll see what actually happens.

That’s really awesome! From the photo you uploaded, it looks like the fee for other customers is also $350 (so I guess it makes no difference?) Or, what is the annual fee for non citigold account holders?

So, was the application with a credit pull, as for US customers?

Thanks,

Sol

@Sol – yes, they finally pulled (Experian) when I called and the agent manually processed my application

How much is the fee for Citigold account holders?

@Diamond Vargas – $350.