Check out our Top Rewards Cards to boost your points earning and travel more!

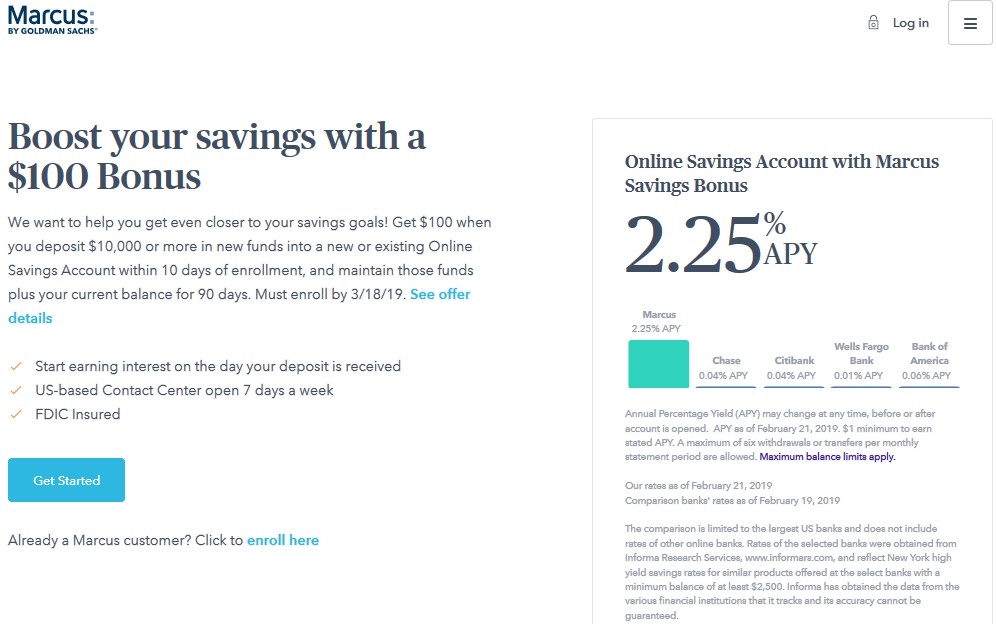

Marcus by Goldman Sachs is an online savings account with no minimum deposit, no account fee, and has among the top current interest rates in the country. The rate today is 2.25% APY.

Account setup is easy as these things go. I opened an account a few months ago where there wasn’t a bonus. I’ll tell you why I did that in a moment.

First, through today March 18, 2019, new and existing customers can enroll for a $100 bonus. See Doctor of Credit for the comments section on this account and offer.

To earn the bonus, you must transfer $10,000 in new funds into the account within 10 days, and leave it there for 90 days.

If you have $10,000 sitting in a savings account earning lower rates, considering moving it over to Marcus.

(Disclaimer: there are no affiliate links in the this post, I will not be compensated for you opening a Marcus account.)

I Have a Marcus Account, But Not for Savings

I have $100 parked in a Marcus account. Why?

The key for me is the ‘by Goldman Sachs’ part:

- Goldman Sachs and Apple are expected to launch a new credit card this year. I want to be on their customer list in case there are targeted offers. I am not an Apple user, and will not become one, so we’ll see how this card takes shape.

- Goldman Sachs may start issuing other kinds of credit cards, too. Again, I want to be targeted if they do.

- A faint hope for a backdoor to the elusive The Platinum Card from American Express for Goldman Sachs.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

So our household opened two accounts and funded them with $10k each. The rate is fairly competitive, especially considering that there is no work to be done to earn that rate, and it’s liquid. Will probably close an account that I opened locally to earn 2.25% because the local bank never got me a debit card that could work at an ATM for cash withdrawals, so the bank might as well be online

The $100 bonus for each account is like icing on the cake.

@Bill – Excellent! I even convinced my wife to do it since the effort required is so low. I don’t believe there is any debit card option for this account if that is what you are after.

I noticed that Marcus posted the deposit immediately, unlike Ally that takes multiple business days, so the debit card’s not a big deal. The local-ish bank didn’t have bank-to-bank transfer capabilities. Online is actually easier.

@Bill – nice.