Check out our Top Rewards Cards to boost your points earning and travel more!

US taxpayers with foreign bank accounts go through an annual reporting ritual called Foreign Bank Account Reporting (FBAR).

Any United States person with at least one foreign bank account, and cumulative value of all foreign bank accounts exceeded $10,000 at any time during the year, are required to file an FBAR.

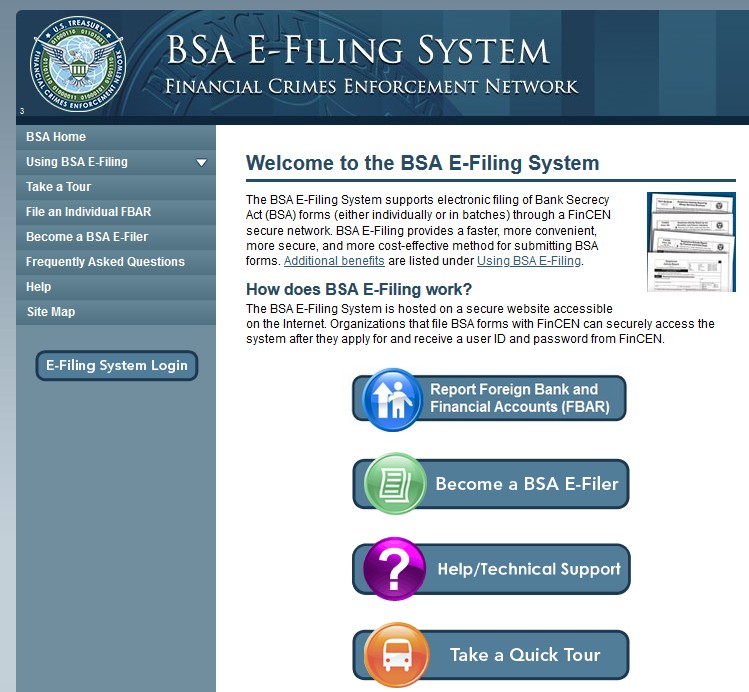

In recent years this has been brought under the umbrella of Banking Secrecy Act (BSA) of 1970 and Financial Crimes Enforcement Network (FinCEN) created in 1990.

April 15 Deadline

The annual filing deadline is April 15. This has not been extended in 2020.

April 15, except, “You’re allowed an automatic extension to October 15 if you fail to meet the FBAR annual due date of April 15. You don’t need to request an extension to file the FBAR.”

I file by April 15, regardless.

BSA E-Filing

The BSA E-Filing system continues to improve.

You still need to create a new PDF form each year and need to make sure your browser opens the form in a compatible PDF viewer (like Abobe Acrobat Reader) rather than in a browser window.

A few days after you file, your BSA E-Filing account inbox should receive a formal filing acknowledgment that you’ll want to log in and save because messages are not saved indefinitely.

Headaches for Expats

The Foreign Account Tax Compliance Act of 2010 (FACTA) upped the bank account reporting requirements, becoming especially onerous for foreign banks to have US person account holders. Some foreign banks responded by terminating affected accounts and refusing to do business with US persons. You see periodic WSJ articles on US expats renouncing citizenship (and here and here) so they can have functional lives in some European countries that are going cashless.

My foreign bank accounts are in China where they are more adept at, or more courageous in, giving other country regulators the shove off.

My accounts are from when I worked in China and no longer have $10,000. I figure it is better to keep reporting at the diminished amounts than stop and invite questions.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

Are you sure about this? I see an automatic extension mentioned on the fincen.gov website.

https://www.fincen.gov/sites/default/files/2020-03/Due_Date_for_FBARs.pdf

@Kay – yes, as noted in the piece, there is the automatic extension to October 15 which is not new (was put in place in 2015), though you need to provide the reason for filing late. My intention was to highlight that recent changes to tax filing dates have not impacted this process.