Check out our Top Rewards Cards to boost your points earning and travel more!

News broke on Friday from the Associated Leff that Diners Club is back for consumer applications in the US. Diners Club cards have airline transfer partners with occasional bonues), a decent selection of airport lounges, primary rental car CDW (excludes Australia, Italy and New Zealand), and is a true chip-and-pin card. There is a lot of misinformation on chip-and-pin, however all the cards from major US issuers, including the Barclaycard Arrival, are not true chip-and-pin (see FlyerTalks’ comprehensive list).

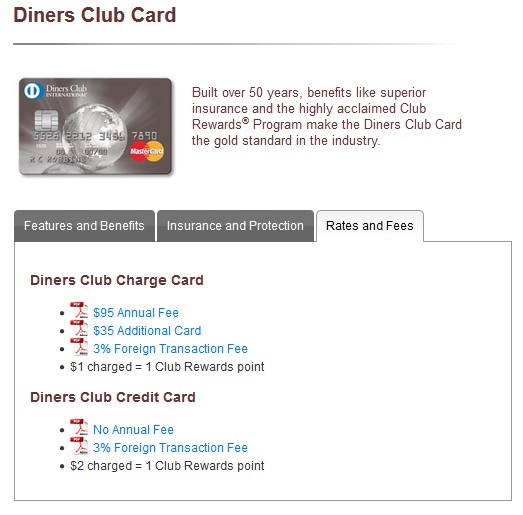

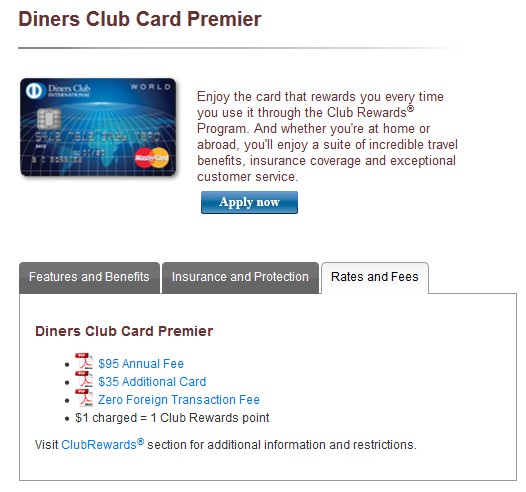

The new Diners Club Consumer cards come in $95 Premier and $300 Elite versions, with no current signup bonus. The Elite version seems to offer little more to differentiate than 3x earnings on drug stores/gas/grocery. See Free-quent Flyer and FrequentMiler exploring the value proposition.

I am an existing Professional cardholder when it was offered with my prior job as a self-paid add-on to their Corporate card. Leaving the company you could keep the Professional account. Side by side the Professional seems identical to Premier, except the 3% foreign transaction fee remains, obviating the value of chip-and-pin overseas.

I called Diners Club and was told very clearly that at this time there is no change to the Professional card. Disappointing. Further, it is not possible to convert to the new product. Only option is make a new credit application. More disappointing.

I have written to Diners Club and hope other current cardholders do so as well. I will wait and watch before doing anything, hoping some realizes they are undermining one of the great values of the card. When I am at a gas pump in Europe I go through every no foreign transaction fee card I have before resorting to Diners Club.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

I was a Diners Club customer long before BMO Harris purchased them. My experience with them was horrible. After being a customer for 27 years, I made an online payment before leaving the country for several weeks. I was in China and had no access to email or phone. When I returned I found out that I had made a mistake when making the payment and it wasn’t posted. After I explained the details to BMO, they decided to post a 30-day late notice on my credit, thereby dropping my credit score by nearly 100 points. When I tried calling… Read more »

@Shannon – most of the time it is pretty good, they list 500 locations: http://www.dinersclublounges.com/, while Priority Pass at 700 (need to exclude United lounges if getting through a US credit card). Most of the difference is Priority Pass might have an extra lounge or two at the same airport, and in some case Priority Pass has a lounge where Diners Club doesn’t, however those are fairly rare in my wide ranging travels. Also, sometimes Diners Club gives a free guest while Priority Pass does not.

That would make much more sense if it’s Mastercard branded. Could you compare the difference of lunge access with other cards?

But why do you want to keep this card anyway? This card is not that widely accecpted

@Shannon – partly sentimentality, partly hope the card would improve. The current incarnation of the US card is issued by BMO and has a MasterCard logo and accepted anywhere in the MasterCard network. They have pretty good lounge access, not as extensive as Priority Pass, but for a $95 annual fee and $35 for AUs it is a nice alternative to lounge access provided by the $300+ annual fee cards.

[…] fun at myself for all those posts, I’ve been called a cyborg and Rapid Travel Chai calls me the Associated Press Leff.) Register for double ppints on Hertz rentals, October 1 through December […]