Check out our Top Rewards Cards to boost your points earning and travel more!

Citi cards have new benefits effective November 23, 2014.

Big news for me is the addition of Trip Delay coverage to Citi Prestige, AA Executive and AA Platinum. Surprisingly Citi ThankYou Premier does not have this new benefit according to Citi’s website, though I do not hold the card and do not have the new PDF Benefits Guide.

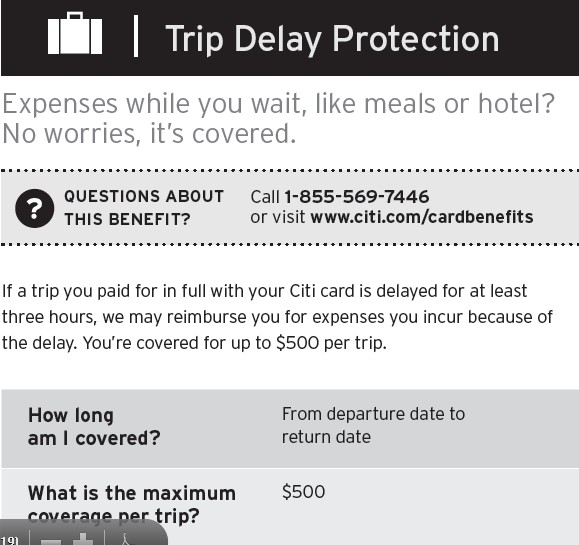

Trip Delay provides up to $500 reimbursement per trip for flights delays over 3 hours for resulting expenses on hotels, ground transportation, meals and necessities.

3 hours is incredible! You can just book United or LIAT and rake it in. Compare to Chase which is 12 hours or overnight. Interestingly, Chase has just upped their coverage from $300 to $500 while maintaining the 12 hour rule (see current Chase Sapphire Preferred benefits).

Coverage applies as long as “The trip was paid for in full including taxes and fees with your Citi card, Citi reward points or a combination of both.” This implies award tickets for which taxes and fees only are paid with the card may not be covered. I have heard reports of Chase verbally communicating that award tickets may be covered on their benefit but have not seen it in writing.

Covered reasons include:

- The delay is caused by a common carrier.

- Your passport, money or other travel documents are lost or stolen.

- You’re not able to board because of overbooking.

- Your trip is delayed because of severe weather, a natural disaster, a previously unannounced strike, a quarantine or hijacking.

See the full terms in the Citi Prestige Guide to Benefits, which are the same for other covered cards.

Ever since I lost hundreds during Hurricane Sandy by booking tickets with Amex PRG for 3x, I have only booked airfare with cards that have Trip Delay coverage.

Also of note, Citi cards now have worldwide rental car CDW on all car types, with a US$50,000 maximum coverage for no annual fee cards and US$100,000 for annual fee cards like the Prestige, AA Executive and AA Platinum. In contrast, most other cards, even when worldwide, exclude many car types.

The only major removal is that of Lost Luggage on some of the no annual fee cards like Dividend and ThankYou Preferred.

Here are the benefits guide PDFs for which I have links:

- Prestige (MasterCard): Trip Delay + 100k Rental Car CDW

- AA Executive (MasterCard): Trip Delay + 100k Rental Car CDW

- AA Platinum (Visa): Trip Delay + 100k Rental Car CDW

- ThankYou Preferred (MasterCard): 50k Rental Car CDW

- ThankYou Preferred (Visa): 50k Rental Car CDW

- Dividend (MasterCard): 50k Rental Car CDW

- Dividend (Visa): 50k Rental Car CDW

Related posts:

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

Too bad you are not covered if you are traveling on an AAdvantage award ticket.

@guera – happy Thanksgiving to you as well. I momentarily passed over that benefit and made a mental note to investigate if over cards have that, now I will do so.

Happy Thanksgiving!

I have been looking for a card that offers medical evacuation coverage as a benefit. I currently hold a Citi AA Executive, and when I clicked on your link for this card I was pleasantly surprised to see this coverage will be included with this card!

“You can just book United or LIAT and rake it in,” Hilarious, but so true!