Check out our Top Rewards Cards to boost your points earning and travel more!

Support the blog / disclaimer: this posts contains links to my friends at Upgraded Points. If you visit their site from my links and apply through their credit card offers, you will support this blog. This arrangement allows me full editorial control since card offers are not directly on my site, while giving readers so moved a chance to support this blog. Thank you.

We went to the Apple Store expecting a quick in-warranty repair to my wife’s iPhone.

The iPhone 7 was 10 months old and not charging.

Apple Warranty Fail

The Apple representative looked it over, ran diagnostics, and determined the issue was a faulty pin in the charging dock. Apple’s warranty doesn’t cover the charging dock, saying by definition a failure of the charging dock is user fault rather than workmanishhip. They wanted $319.00 to do a swap. We had not purchased AppleCare+ because in a decade plus of phones, my wife has never damaged any of them.

We were nonplussed. Escalation in-store did not work. One representative quietly suggested we might get a more favorable result by using Apple’s mail-in warranty service.

For the time and effort of mail-in, all we got was the unrepaired phone back a week later with a note that we should be thankful that Apple was not charging us a diagnostic fee since we had declined the costly repair.

The idea of getting an external charger flopped because Apple did not include that capability in iPhone 7.

I was ready to smash the phone with a hammer and have my wife move to an Android phone.

Then we realized her new Chase Ink Business Preferred has cell phone protection coverage and she had just started paying her T-Mobile bill with the card. A new hope!

Chase Ink Business Preferred Cell Phone Protection

Chase Ink Business Preferred cell phone protection offers up to $600 coverage per claim, with a $100 deductible per claim. There is a 3 claim per rolling 12 months limit.

There many many online guides to this coverage. None release you of the necessity of reading the actual terms from Chase. Plus, most of these guides are written by people who fortunately have not needed to use the coverage.

Here are the key questions we had that only got answered in our claims process.

Cell Phone Protection Questions Answered

Q: My phone is part of a family plan and I am not the primary plan owner. Is that ok?

A: Yes. My wife is secondary on a T-Mobile 55+ plan with my mother. The T-Mobile website’s Plan Details showed my wife’s name and number by the iPhone she uses, which was sufficient proof.

Q: I am paying for the phone by installment. Am I covered? (the coverage excludes ‘leased’ phones)

A: Yes. The phone purchase receipt and monthly statement show the installment payments. There was no issue in the claim.

Q: Do I need to get claim pre-authorization?

A: No. If time is of the essence, you can get your phone repaired and file the claim after. The risk is that your claim may be denied and you stuck with the repair bill.

You need the repairer to provide you a Work Authorization in addition to payment receipt for the repair. This is particularly useful if you would pay $100 or more to not have to go to an Apple Store again (me).

To get pre-authorization, you need to go to the repairer, have them submit the Work Authorization to the Benefits Administrator and wait 48 or more hours for a response.

We got our phone repaired first without pre-authorization. We then submitted all the documents and the claim was approved without issue within a few days.

Q: What documents do I really need for a claim?

A: The documents we submitted are:

- Claim form (online)

- Phone purchase receipt

- Phone service plan details

- Phone service monthly billing statement

- Credit card statement showing the corresponding monthly phone service charge

- Repair work authorization

- Repair receipt

Q: Do I need to prove the phone is for business use?

A: No. You just need to pay for the phone service with your card and the phone service statement needs to match your name.

Q: Do I need to call to file a claim?

A: No. You can get everything online.

Q: What is the website to file a claim?

A: https://www.cardbenefitservices.com/

Q: Why do I keep getting errors in registering a product (not required) or filing a claim?

A: The website is terrible. Try different browsers and hope one works.

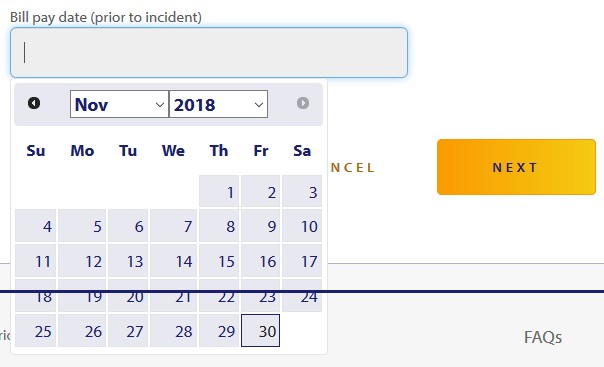

Q: Why can’t I enter the current month for “Bill pay date (prior to incident)”?

A: This is the biggest hassle we had. Calling in only got us to confused agents. We ended having to wait a few weeks to file our claim.

A: This is the biggest hassle we had. Calling in only got us to confused agents. We ended having to wait a few weeks to file our claim.

The issue seems to be that this website is also used for the Wells Fargo Propel American Express which has different terms. The agent we spoke to quoted us the Wells Fargo terms, not Chase.

Wells Fargo coverage, “begins the first day of the calendar month following a payment of the cellular wireless phone bill.” This has practical effect only in your first month: paying the bill on the 15th means you have a 2 week gap until the 1st of the month and you are coverage. One you are into your second month with Wells Fargo you are fully covered.

Chase coverage, “begins the day following your cellular wireless telephone bill payment and remains in effect until the last day of the calendar month following the payment.” Even in your first month you do not have a coverage gap with Chase.

Holders of Wells Fargo cards, of which I am newly one, find other difference in coverage. Most notable that while the per claim limit is still $600, the deductible is only $25 while there is a limit of 2 claims per 12 months.

If you are looking to get claim pre-authorization you may get stuck here and need to call in rather than use the website.

Q: Any surprises?

A: Apple charged us sales tax (10.1% in Seattle) on the repair. The claim check we received excluded the sales tax. We paid Apple $319 + tax. We recevied a claim check for $219.

Q: Will Stefan ever go back to an Apple Store (after 3 dispiriting visits)?

A: He hopes not. A pyschotic experience.

Q: Will she switch to Android?

A: We’ll see.

Q: Where can I get the Chase Ink Business Preferred card?

A: Why, right here. Earlier this year the offers to apply in branch were better than applying online. My understanding is that all offers are currently the same.

Related posts:

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

THAnk sure for this. Did your wife pay the full bill or just her phone? Would her mothers phone be covered as well?

@Bob – yes paid the full bill. Mother’s phone is iffy, she is not an AU on the card, and I did not find anything in the terms to explicitly say she would be covered.

Does it cover non US based carriers? Say, I am traveling for an extended period of time outside the US and have a post-paid plan with a carrier there. I don’t see anything in the terms that exclude certain carriers, but I am not sure if they are covered either. It would be great if you can let me know – thanks!

@Jaguar – I haven’t come across anything requiring that. They may make you get an English translation of the bill. Insurance is always looking for a way to deny claims, so could he a fight anyway. Probably best to make clear you are US-based and phone use is primarily in US except occasional travel.

@Jaguar – I can’t find any reports of that. Insurance always looks for a way to deny so at least provide an English translation of the statement, and also emphasize that you are based in US and phone primarily used in the US even if provider is elsewhere.

I think what @jaguar is asking as would I, is that if I use the card to charge my mobile phone service from a carrier not based within the US (I myself have plans with tmobile in the US and also with a Philippine carrier Globe), if I were to charge all of my bills to Chase Ink Preferred, would I still receive the same insurance on the phones used?

@Nirav – you should, nothing in the terms explicitly says not. Speaking from my insurance background, these companies do look for any way they can to deny claims so prepare to have pushback.

[…] Successful cell phone protection claim with the Chase Ink Business Preferred℠ Credit Card which also has in my view the very best initial bonus offer (80,000 bonus points after you spend $5,000 on purchases in the first 3 months) and offers great earning. […]

Paid portion of phone with Chase preferred but have since then downgraded to Chase INK cash and paying the installments with it. Will I have the coverage if needed?

@Ab Shar – sorry, no, that Ink Cash does not have this coverage. You were only covered with the IPB for the months you paid the monthly phone service bill with it. If you have a Wells Fargo card, consider paying the bill with that to get similar coverage.

Does the Ink Business Preferred card have to be used in the first month of my installment plan? I signed up for my cell service over a year ago but don’t remember if it was using this card. Also does it still count if the card was the Ink Plus version prior to converting it to the Ink Business Preferred over a month ago?

Thanks.

@Kevin – no, it is month to month coverage. My wife did not then have the IBP. She only got the card and started using it to pay the monthly statement shortly before the statement. Phone receipt from a year ago shows a different card and was not an issue.

what is “Work Authorization”? do repair shops know what this is if mentioned? or is it a form from the insurance provider?

@Kyle – I was concerned about this when originally calling the benefits administrator and it turned out to be no big deal. For Apple it is part of their regular process. The Apple rep takes notes from you and their evaluation and that work authorization is what they get you to agree to before they perform any repair or replacement work for you or an insurer. They normally email it to you though you can ask for a hard copy. We visited an independent repairer in this process that could not fix it, however, they have the same process of… Read more »

Does the phone have to be purchased brand new? Can it be refurbished, or even, used bought from eBay?

@Park – the only published exclusion related to that is “Replacement cellular wireless telephone not purchased from a cellular service provider’s retail or Internet store, (for example:

Verizon Wireless, Sprint Wireless, etc.) or from an authorized cellular phone retailer.” This implies a swap device provided by a carrier or dealer for damage you had on another device, and which is likely a refurbished device. In practice, I have haven’t seen data points on an eBay phone purchase.