Check out our Top Rewards Cards to boost your points earning and travel more!

You just jumped on the (now expired) Amex Platinum 100k offer or the (still going to 6/22/16) Amex Platinum Mercedes-Benz 75k offer. If this is your first Amex Platinum, there are a bewildering array of benefits, many of which only come to those who ask. Here’s how to get started.

Disclaimer: I am not compensated by Amex for use of this or any other Amex link on this blog.

- Activate the card when you receive it. DO NOT set up Extended Payment Option because from time to time there is a 10,000 point offer to enroll, so bide your time. You may have been given the option to get the card number in advance when you were approved. Set up your online account, note the statement close date for bill pay reminders and set up your bank account for bill payment.

- Decide if you want any Authorized Users at $175 a year. Some but not all benefits apply to Authorized Users.

- Make a plan to meet the minimum spend to collect the bonus. The current offer requires $3,000 spend in 90 days. The $450 annual fee does NOT count, don’t make that mistake. I always conservatively count from day of application and try to complete the spend at least a month early so bonus can post and leave time if there are any issues. FrequentMiler has great resources including How to Increase Credit Card Spend and 9 Ways to Increase Credit Card Spend Without Leaving Home.

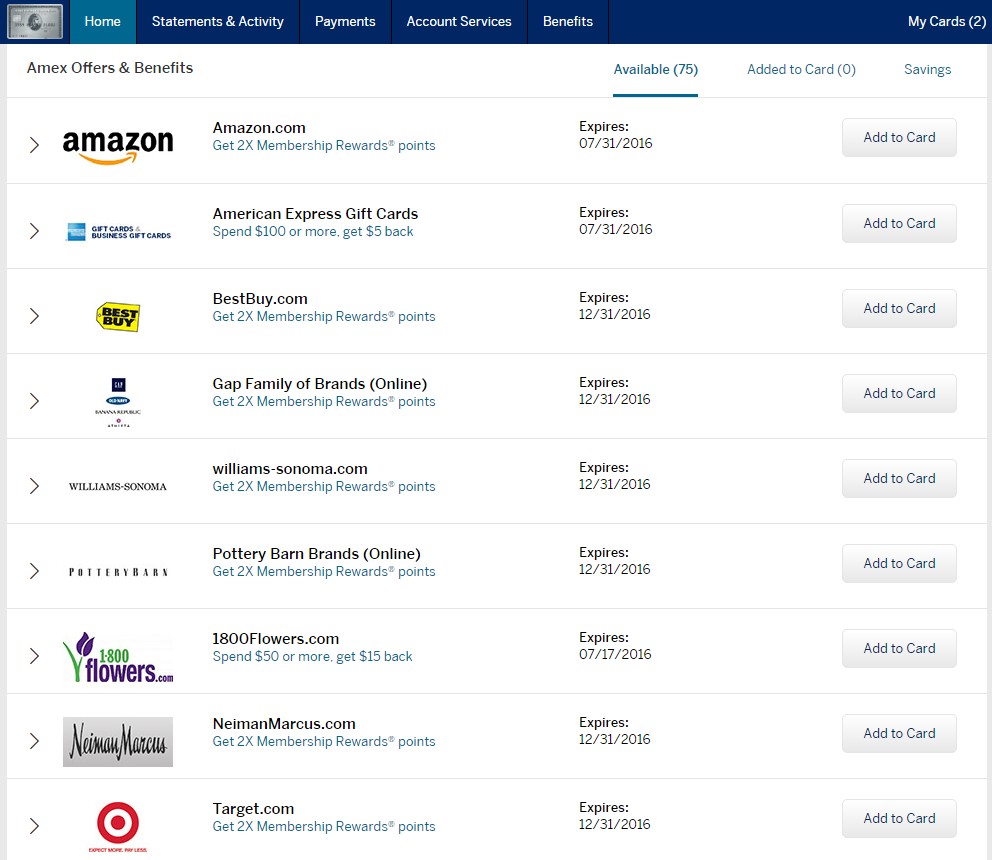

- Scroll down the account page to familiarize yourself with Amex Offers. My father’s new card has excellent offers for 2x Membership Rewards for Amazon through 7/31/16 and Target through 12/31/16. You must opt in to these offers. They change frequently and are different among cards you may have.

- Visit Rewards -> Point Summary from the top menu bar. If you have other Amex cards with Membership Rewards, perhaps an Amex Corporate card, you want all those cards to show in the Your Cards box on the right side. This way the points are pooled and if you close any accounts, as long as one stays open, you won’t lose your points. If a card is not auto-linked, contact Amex.

- While here, continue to Link Loyalty Programs. In the future you will want to transfer Membership Rewards points to airline and hotel programs. The linkage is not always automatic so do it now for programs you might use so that you can jump on award availability. If you are not a member of certain programs, you have the option to enroll. Make a mental note to research programs unfamiliar to you that may be valuable. For instance, Lazy Traveler’s Handbook has done an excellent series on ANA Mileage Club, see part 1, part 2 and part 3. Sometimes these programs offer limited-time transfer bonuses. Currently Etihad (till 6/15/16) and Virgin Atlantic (till 5/31/16) have 30% bonuses. At this point resolve to NEVER redeem Membership Rewards for travel or statement credit or anything but transfer to Airlines where you almost always will get the best bang for your buck if done well. If you want cash rewards, then get a cash rewards card with better earning. These points are for transferring.

- At the top menu bar, click Rewards again and to the right see Complimentary Card Benefit with a link to enroll for free ShopRunner, a program that provides free 2-day shipping at many popular online stores. Might as well sign up!

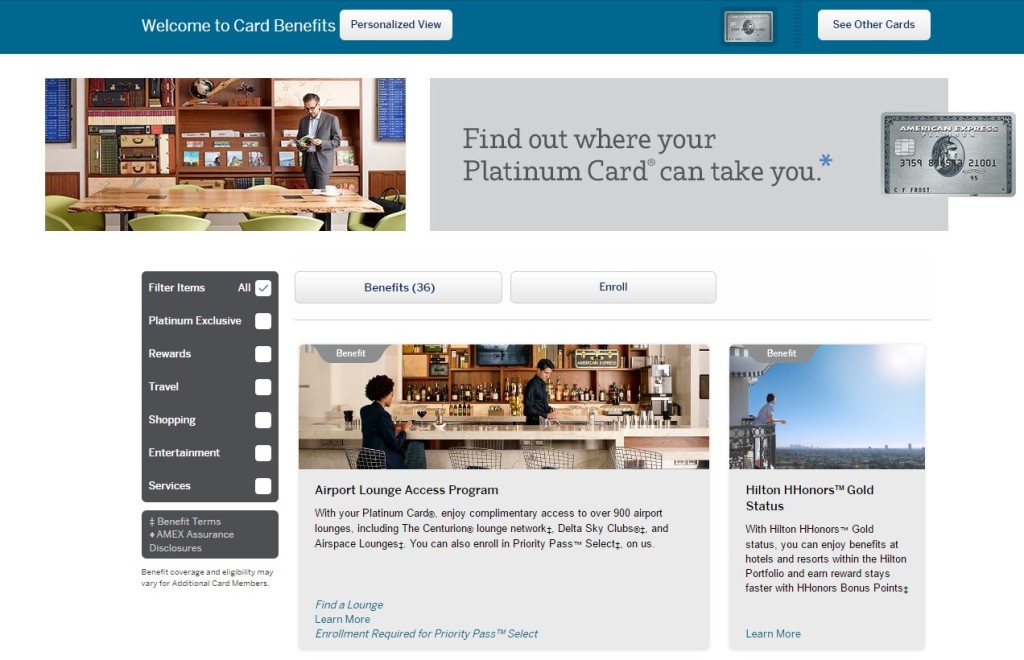

- Now we dig into the many Card Benefits. You can access from the top menu by My Account -> Card Accounts -> Card Benefits or direct by this link. Steps 8-20 are all from this screen.

- Airport Lounge Access Program – Centurion Lounges. These Amex lounges in the US are top quality. You get immediate family or two guests, except in tiny Seattle where you are limited to one guest.

- Airport Lounge Access Program – Airspace Lounge. This a new network of 4 US lounges (BWI, CLE, JFK T5, SAN) where you and up to two guests have complimentary access.

- Airport Lounge Access Program – Delta Sky Club. Cardholder only, next two guests are $29 each (even immediate family) and more are full Day Pass price. If using this benefit often as a couple or family, consider Authorized Users which get their own complimentary access.

- Airport Lounge Access Program – Priority Pass Select. Enroll. Priority Pass is a network of 900+ lounges around the world. You will be mailed a member card as well as can download the Priority Pass and get a directory and virtual card valid at many locations.

- Hilton HHonors Gold Status. Enroll if you don’t already have Hilton Diamond or Gold status.

- Airline Fee Credit. Wait a bit on this one until you have a plan. You pick one airline per year to get a $200 credit. There are many strategies for this so research them first. New methods appear from time to time, such as Tips & Tricks from The Reward Boss. This is calendar year so do $200 this year and set a calendar reminder for January 1 to do another $200.

- Fine Hotels & Resorts. Familiarize yourself with these offers, which can be quite competitive when free nights and various credits and benefits are combined. Sign up for the independent FHR News newsletter that tracks these offers. There is also a separate hotel discount program called The Hotel Collection.

- Fee Credit for Global Entry or TSA Pre✓. This benefit is good every 5 years and can be used to pay for anyone’s $100 application or renewal.

- Boingo American Express Preferred Plan. Enroll. This is worldwide wifi hotspots. Most usefull to me are US airports and many places in Europe, including some hotels that otherwise charge for internet. Their app makes sign in easier and has a basic VPN, so consider setting it up on your devices.

- Starwood Preferred Guest Gold. Enroll if you don’t already have SPG Platinum or Gold.

- Car Rental Privileges. Register for Avis Preferred, Hertz Gold Plus Rewards, and National Car Rental Emerald Club Executive. The National status is the most useful because of their slick Emerald Aisle for members renting intermediate or above at participating locations. For Avis use AWD code A756900 for up to 25% discount, for National Contract ID 5028695 for up to 20% discount. With Hertz use CDP# code 211762 for “up to 20% off your rental, or up to 25% off the best contract rate on Hertz Prestige Collection weekend rentals, as well as a 10% bonus on Hertz Gold Plus Rewards®, a 4-hour no-charge grace period before an extra day charge is applied, and a one-car-class upgrade subject to availability.” See Hertz’s terms for exceptions. The 4-hour grace period applies only to the car daily rate, not extra such as insurance or taxes/fees which are charged an additional day.

- Study other Travel and Protection Benefits. as well as concierge, entertainment, etc to see if any are of value to you. Most are automatically covered, unlike the above that required enrollment. Some have been superseded by competitors, though Amex customer service retains many cheering fans such as for extended warranty.

If you have a new Amex Platinum Business card, you have additional benefits to research, see here!

Readers, what did I miss?

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

[…] For example, Stefan has an excellent checklist of what to do if you just got an Amex Platinum Card. […]

Does the MPX trick for the $200 not work with the Business Platinum?

@Cy – I believe it still does.

[…] You Just Got an Amex Platinum, Here are 20 Things to Do (and 3 Not to Do) – For anyone who got in on this week’s 100K offer. […]

@John – not sure, I would only test it with a month or more to spare. In any such promotions or credits I assume they won’t count, and I would rather avoid fights with customer service if systems treat them adversely.

does the airline 200$ that is reimbursed count towards minimum spend?

@DavidNJ There is a fallacy in your points plan: You won’t get BOTH the 2X MR points and the airline fee credit, if I calculate correctly. The reason the $50 will count for the fee reimbursement (if it does) is that the charge will code as United Airlines. Therefore, it won’t also code as Amazon. Of course, United is the one you’re hoping for.

@DavidNJ There is a allacy in your points plan: You won’t get BOTH the 2X MR points and the airline fee credit, if I calculate correctly. The reason the $50 will count for the fee reimbursement (if it does) is that the charge will code as United Airlines. Therefore, it won’t also code as Amazon. Of course, United is the one you’re hoping for.

[…] You Just Got an Amex Platinum, Here are 20 Things to Do (and 3 Not to Do) by Rapid Travel Chai. Nice checklist of the things you should be doing if you’re a new Platinum cardholder. […]

@Rich T – the only one they proactively cancel is Priority Pass, so opt in right away on the new card. Others such as hotel and rental car status whether you keep the card or not can require annual manual intervention if your status drops.

Subscribe

Some gems in here! Question – i was able to get approved for this 100k deal while in month 11 of holding the Ameriprise Platinum, so I now hold both. For all the great benefits, do I need to re-sign up for all of them after I cancel the Ameriprise Plat? Or will they know I still have an active Platinum?

Did a $50 Amazon GC through the MilagePlusX. I will receive 2X United miles and 2X MR points due to Amazon 2X bonus promo. Will wait and see how it posts. If successful reimbursement, I’ll buy the other $150 next week. Thank you for the walk thru!

Great post, thank you! Knowing exactly what benefits apply to Authorized Users would be helpful, too!

If you cancel the card say after 6 months, is the Annual fees pro-rated ?

@Gary – yes, they pro-rate. Next Jan you could get the next $200 airline credit so if you are using the benefits I would at least wait until then.

Not sure but is road side car assistance included? I know it is with the business version..

@Abbas – yes, it is, terms here, you are automatically included and call 1-800-333-AMEX should you need their service.

I am guilty of using amex points to bring down the cost of travel one time. To buy a ticket to Syd brought it down by few hundred dollars. Award flights werent avail in premium cabin.

Thanks. Very useful to see this information all in one place.

Great post. Super helpful, thanks!

Thanks for the mention Stefan!

I do love the FHR program, for people who travel, but not enough to be VIP at a hotel chain, it pays for itself with a single free night or a suite upgrade!