Check out our Top Rewards Cards to boost your points earning and travel more!

The US Bank Club Carlson credit cards are my new favorite hotel cards, I have used the 2nd night free award benefit for bookings this week in London and Istanbul.

A few days after these cards launched in December I applied and was approved for both the personal Club CarlsonSM Premier Rewards Visa Signature® Card and the business Club CarlsonSM Business Rewards Visa® Card. At the time I neglected to save a screenshot of the offer, and do not know if the following language is recent, both cards contain the following terms in the footnotes:

New Account Bonus: To earn the one-time First Purchase Bonus of 50,000 Gold Points, you must first make a purchase with your Club Carlson Business Rewards Visa credit card (“Card”) within 90 days after your Account was opened. You may earn an additional one-time Spend Bonus of 35,000 Gold Points if you spend at least $2,500 in Net Purchases on your Card within 90 days after your Account was opened. Once you qualify for either the First Purchase Bonus or the Spend Bonus (collectively referred to as a “New Account Bonus”), please allow 6 to 8 weeks for the Gold Points to appear in your Club Carlson account. Neither New Account Bonus is available to applicants who have had this Card or another Club Carlson credit card product within the last 12 months. If your Account is not open for at least 6 months, Club Carlson and U.S. Bank reserve the right to deduct the New Account Bonus Gold Points from your Club Carlson account.

Other card issuers often exclude bonuses for same or similar personal cards, or business cards, but excluding a business bonus due to a personal card, or vice versa, is new to me.

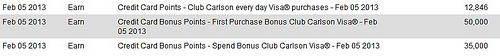

Fortunately, both my bonuses posted though at first I thought they had not.

Both statements cycled on the same date and same-day the 85,000 bonus points for the personal card, and 15 elite qualifying nights (because I already had Gold status), all posted in my Club Carlson account.

Where were the business card points? Online statements had a problem that will require a separate post and were not useful. I called the automated line for the business card and the system said I had earned the points. I delicately called a representative, not wanting to call too much attention to the personal card. She said points were on the way and to sight tight.

Then I noticed a number on the back of my business card with the same length as a Club Carlson number but not my number. I went to the Club Carlson website, set up access, and found a duplicate account in my name with the business card’s bonus. I had used my Club Carlson number on the application but the system assigned me a new one anyway, interestingly the same thing recently happened to me with a Bank of America card.

It is so easy to transfer Club Carlson points that I am not going to call attention by merging accounts and changing the Club Carlson number on my business card. I did lose out on 15 elite nights to my main account since Gold status was awarded to the new account, but I am not in the market for Concierge status.

Best practice, though it apparently will not make a difference, is to use your Club Carlson number on the personal application and leave it off the business.

Good luck to all who apply for the Carlson double.

Disclaimer: I do not receive any commission for the Club Carlson credit cards.

Related posts:

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

Did you ever transfer points/try to merge accounts? Thankfully stumbled on this post when wondering where the heck my points were.

@PointPrincess – I have decided to let it sit. Until I run low on points I figure I will keep them separate. I won’t call attention by trying to alternate stays with the accounts.

@BOShappyflyer – I just went through the same double log in issue with Bank of America. They are even worse. Setting up the small business accounts for online access requires a phone call. Small business accounts show in personal accounts but payments cannot be made.

Thanks Jason. I have a personal and a business one, and I can download the business statement from the personal account. After setting up a separate login, I could see the statement with the appropriate information posted. Thanks!

P.S. Thanks. 🙂

Never mind. It’s worth it to read through your blog. Just read this post: http://rapidtravelchai.boardingarea.com/2013/02/21/us-bank-business-card-online-management-beware-the-0-balance/

Seems like I will have the same problem. I’ll check that and see if the bonus is posted once a separate account is set up.

Same situation, so many thanks to your post! I was wondering what my new number was, and was able to register via the website using the CC number on my back of my business credit card. Thanks!

I do have one concerning question — my business statement online posted today (points does not appear at all, not even regular spend) on my statement. Unlike the personal one, did the points appear on your business statement?

The points on the business card will post on the BUSINESS version of the statement, not on the employee version as you see nothing there. Both statements are available, but via separate logins online, I believe. Call cust svc if stuck.

@Kam – great info to know, thanks.

@RTC So, I spoke to club carlson. They are fine with me having two accts (since one is personal and one is business) and I was told that I could transfer points from personal to business but not the other way around. But they didn’t even entertain the thought of merging accounts. And given the benefit of each card/account, I think I rather not merge anyway 😉 Thanks!

Were you able to transfer points from your business cc acct to personal? When you transfer, don’t they ask for the name of the member of each acct and would having the same name on both accts cause any issues? Maybe it’s better to merge both accounts?

Also, I was assigned a new club carlson number for my business card, but when I try to register it on club carlson site, it keeps telling me a profile is already set up and the email (one I used for my business app) does not match the profile. Very frustrating.

@Kam – I have not tried a transfer, I agree with your reasoning and so have kept the account separate. Merge seems better if needed. For the second question you may have to call Club Carlson with only reference to the account having issues, I guess if they find the two they will just merge them.

I have been reading this is a tough card to be approved for if you have many apps in past 6 months to year! I started this in September of 2012 and have applied and been approved for 7 cards in that time (3 apporamas) . . . Last apporama was in early March for 2 cards. I have no US Bank. Is that too many to get approval do you think?

Should I apply or do I need to wait 6 months or longer? UGH

@BDF – it is hard to predict, I would wait till 90 days from your March app but probably would not skip a 90-day churn just in the hope it will be approved 3 months later.

I didn’t read the fine print either. Had the personal card 3 months ago. Approved for the biz version and received card two days ago. Know of anyone who received both bonuses?

Sil, I got both bonuses; Carlson assigned me a different Club acct # for the business card, compared to the personal acct; both bonuses posted one month apart, within days after the statement closed where the spend threshold met. Good luck!

[…] did get the bonuses for the personal and business Club Carlson credit […]

[…] Originally Posted by umc Hmm, I hope this won't happen to me. I bought VRs at CVS using my Club Carslon once. My wife bought VRs with her Club Carslon about 3 times 2 months ago. She has not been shut down. She used her card for other places. Where did you see such report? See the comment section of the blog: http://boardingarea.com/rapidt…bonus-success/ […]

Even with 2 separate accounts ?

I just stayed 2 nights at the Radisson martinique in nyc and they did not seem to even notice/care that i was using points/free nights

@Sruly – I don’t have data on that, no idea how carefully they check things, I suppose try it with the possibility, perhaps small, that they would not honor the free night in the middle, wouldn’t be the end of the world, I wouldn’t constantly do it, don’t want to abuse and create a pattern.

I applied for both with the club carlson same number and got instant approval for the personal and approval for the business one a week later.

The personal had my club number on it and the business one has a new number.

do you think that we can make 2 2 night reservation with it with points, so that we are only paying 2 nights of points for a 4 night stay ?

@Sruly – technically this may work to book it, but it likely will get flagged and be an issue later, hotels are wise to people checking in and out for various reasons and you are typically going to be counted as one stay, which is why people, say, do one in their name, then one in their partner’s, or switch hotels hotels.

[…] Travel Chai proved that its possible to get the signup bonus for both the personal and business Club Carlson cards. So, here are the cards I plan to signup […]

Gents, try making some common everyday purchases with the Club Carlson VISA for a few weeks (establish legitimacy), then buy the AFT prepaid card in a denomination under $1K (I did this with success). Then do some more everyday spending for a few weeks; then buy more VR or giftcards or reload AFT in final 2 mos of the three mo period. That should do it to meet spend.

And the 5 pts/$ is good, so throw them some bones for the next 6 mos (spend some more) to show your appreciation 🙂

@Jason – I agree, and I do always mix in some spend but was too quick on the trigger for the VR. They are good overall cards, would be nice to drop the fx fee.

@john – they kept freezing me, too.

The other interesting thing is that yes us bank is very conservative. Wife and I are just about done working through 12 credit cards each of minimum spend (jan/feb). probably around 50k total. us bank was only one to do a fraud freeze.

now the other thing is that every time i open my bank account and see the extra 50k in there…. i am very tempted to cash out and declare bankruptcy. damn.

we were not successful with this. both wife and i went for both cards. Both of us got just the personal. first us bank card. not many credit inquiries in past six months. I didnt really care so good enough. Funny thing was we started going to CVS and of course they shut us down. Called in and opened it up again. Went back to CVS and they shut just me off again. This time it was not fraud prevention but “new accounts”. Wanted paystubs to verify income. faxed them in. oh but it does not match what you put… Read more »

Called and they refused to switch or upgrade. But the credit department rep said that I can apply for the Premier card and if I qualify and if they are having the same offer, I’d be eligible for the 85K cc points.

The annual fee is not waived, correct?

@Matt – correct, not waived for any of the Club Carlson cards.

I just got rejected for this card because I’ve gotten a lot of Credit Cards in the last year. Do you know how far back they care about? So if I got no new credit cards in the next 6 months should I be able to get this card even though I have had a lot in the last year. I have no US Bank cards.

@Paul – reports on US Bank are limited and all over the map, I might try in six months, or if you want to be cautious, watch for others’ experience a bit longer.

By stating the cheaper one, I meant to say I received the signature card with 60K cc bonus points.

I applied for the 85K point premier card and instead got the cheaper one after 50 days!!! Any possibility getting the premier CC card soon?

So, if I’m reading this correctly, you believe there’s a chance that a person can apply and receive the 85,000 personal and then apply for the business card without your Club Carlson number on the app and get the business 85,000. Has anyone else out there in the internet world succeed with this approach? Just wondering…

@Jim – I got them even giving my number on both. I have not seen other reports yet, these cards are very new. @Kalboz – By their terms, no, unofficially I imagine you have already called in to try to get them to issue the Premier, I don’t have any evidence that they have an upgrade process but maybe call again in a few months of spend and paying your bill on time and see if they will upgrade, even if you don’t get the 25k difference it may be worthwhile for the card’s benefits rather than canceling after a… Read more »

Had you had any other US Bank cards before this? I was thinking about trying this, but I would be a new customer, and you never really know how banks will treat you with no personal history…

@MrAlexMoore – my first cards with them, no prior applications.

@Lucy H – they pulled TU in NJ and in the 6 months prior to application had 2 TU inquiries.

May i ask how many credit inquires you had in the last 6 months and did they pull TU? I am interested in these cards but read that they are real strict with too many inquiries. I did not apply for any cards since August but had too many inq earlier in 2012.