Check out our Top Rewards Cards to boost your points earning and travel more!

Avianca LifeMiles is popular for its frequent mileage bonus sales that can offer strong value for Star Alliance premium cabin awards.

Economy awards are generally poor value when purchasing their miles, especially, and oddly, awards on Avianca flights.

LifeMiles has a capable search engine. From those who frequent the program, the advice to stay sane is to book whatever the website gives. Don’t waste time trying to call the contact center for anything beyond the website’s ability.

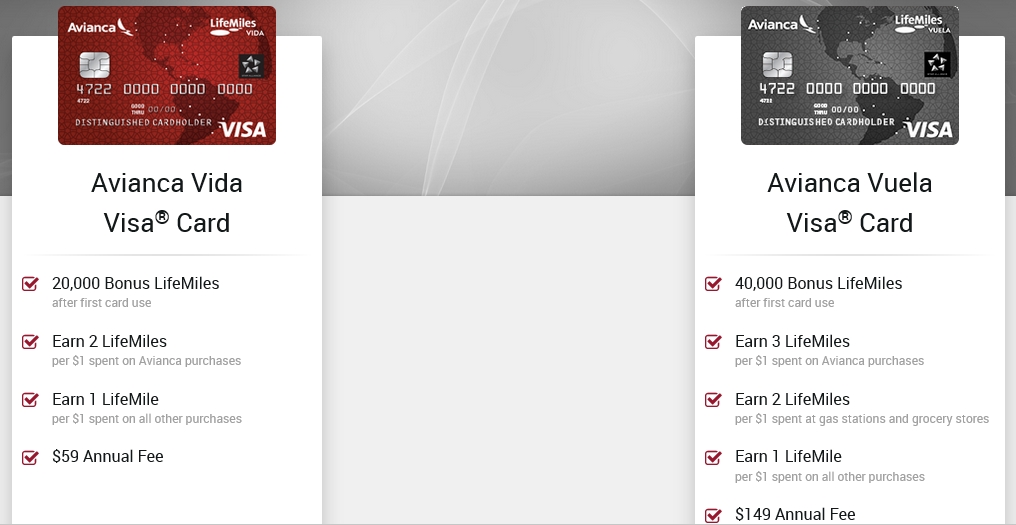

Avianca LifeMiles Credit Card

The credit card moved to Banco Popular de Puerto Rico late last year.

The Avianca Vuela Visa has a $149 annual fee not waived first year. It comes with a 60,000 mile bonus upon first purchase.

The Avianca Vida Visa is $69 with a 40,000 mile bonus upon first purchase.

To get these increased bonuses you need to enter code: AVSPWE on the application page. Without the code, the bonuses are 40,000 and 20,000, respectively.

Disclaimer: I am not an affiliate of Banco Popular and receive no commission for your application.

LifeMiles Credit Card Value

Both cards bonus Avianca spend, which is probably not high for most of us.

For everyday spend, the Vuela earns 2 miles per dollar at gas stations and grocery stores which is a solid value.

The Vuela has additional travel benefits on Avianca:

- Two 50% discounts on award tickets redeemed, applicable for travel to Central America or Colombia from the United States

- Free additional piece of baggage for travel between the United States and Central America

Should You Get the LifeMiles Credit Card

Starting up in a new airline program you should be willing to invest the time to learn the system and manage your account. One credit card bonus is nice though alone insufficient for most travel goals.

To jump in on this you should:

- Understand the value proposition of LifeMiles

- Have a plan to use your LifeMiles

- Estimate cost of purchasing LifeMiles to top up accounts for awards (promotional bonuses are frequent and take various forms)

- Be aware that while SPG points do now transfer to LifeMiles, no major US credit card programs transfer to LifeMiles

My LifeMiles Credit Card Experience

I got the Vuela card in January. Auto-approved.

My credit report is way over ‘5/24’ in the Chase parlance.

Most reports I have heard are for approvals, with only a few denials.

Double or Triple Your LifeMiles Credit Card Miles

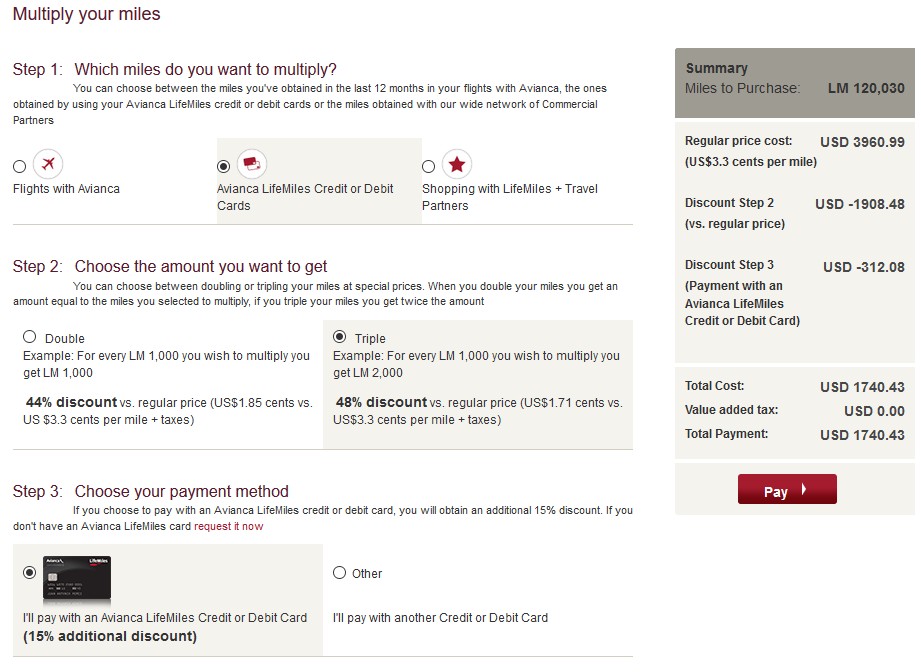

LifeMiles has an option to double or triple your miles earned with the credit card. You get a 44% discount off regular purchase price when doubling, 48% for tripling, plus additional 15% using the LifeMiles credit card to purchase.

Those purchases should also qualify for the credit card’s 3 miles per dollar for Avianca purchases (2 miles per dollar on the Vide card).

Add it all together and if my math is right, it is still not as good as the frequent purchase miles sales.

My offer on 60,015 miles earned first statement is $1,740.43 to triple.

Questions Ahead

- Can you get both versions of the card? At the same time?

- Can you repeatedly get the card?

- How frequently can you get the card and do you need to have closed the prior?

Related posts:

Etihad Business Class Awards Wide Open for North America - Abu Dhabi (Book from Air Canada Aeroplan)

New BofA Business Card Launched Today with $500 Bonus

Saks Friends & Family Sale to 10/4/21 + TopCashBack 10% - Use Your Amex Platinum Saks $50 Credits

Citi Dividend Q3 2020 5% Cash Back Categories Announced

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

Thanks for this tip and for the redemption code. I got the Vuela Visa card in the mail on March 21, made a $3 donation to Wikipedia, and got my statement for $3 + $149 on March 25. The 60,000 points posted on March 25 too! I’ve made a note in my calendar to cancel the card next year.

Of, depending on your view of what’s fair, you cancel now and they refund the $149. This is what many did when Citi AA Executive cards were churnable.

I don’t want the bad juju from doing that.

Understandable. Keeping the card it makes a good case for gas and grocery use. If generating spend is not an issue for you, hitting $12,000 to get the 50% off Avianca award may have use, Travel is Free took a look at it. http://travelisfree.com/2017/03/21/avianca-life-miles-credit-card/

If you sock-drawer it, in the 11th month make a charge so that your LifeMiles expiration resets.

Intriguing option to triple miles. Might have to consider this card at some point. So, did you end up buying the extra 120k miles?

Nope, only time I have outright bought miles was Avianca, and there they sit. That was when Istanbul SAW priced as Europe. When I finally found availability and dates that worked, the fixed the error.

thanks. this post is most useful!

so wouldn’t it be better to get 40000 points and pay $59 if the code works?

I’m not sure if I will devote the time to learn the program, although the miles are enticing, and I too am way over 5/24 (no regrets there). Could you share a bit with us about the expiration policy? Or any other quirks those new to the program should be sure to be aware of?

Activity once per year, one option is a charitable donation of as little as one mile. The program used to have miscoded airports with advantageous pricing, those are all gone as far as I am aware. Also, pre-2016 mixed cabin awards were not allowed. Now that they are, it is easier to find awards. Lastly, trying more obscure airports or routes such as ones I wanted for Ethiopian in Africa often did not succeed while United and Aeroplan did. The program is primarily for people with the cash to buy miles at good value over revenue tickets for Star Alliance… Read more »

which credit bureau does this bank use?

I have only found scattered reports, one from CA is EQ, one in NY claims both EQ and TU.