Check out our Top Rewards Cards to boost your points earning and travel more!

Amex allows a credit limit increase on credit cards 60 days after account opening, and one credit limit increase, per card, every 6 months.

A credit limit increase can be done online or over the phone.

Recently Amex has been very stingy with me in credit on my new cards, the lowest was last August’s Platinum Delta SkyMiles® Business Credit Card for which I was only granted a credit line of $3,000. In 2013 I am going for the 10k MQM ‘Mileage Boost’ for reaching $25k annual spend, and then another 10k for reaching $50k, so I needed more credit.

I canvassed various sources and experts and the answer consistently came back that if Amex is going to approve a credit limit increase, the maximum is almost always 3 times the current credit limit. Further, that asking for more does no harm because they will just approve for the 3x credit limit.

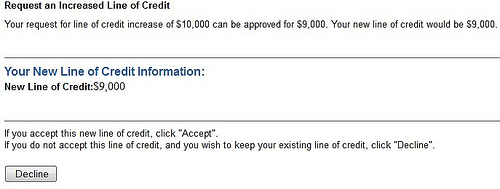

I requested the credit limit online, asking for $10k, sure enough, it came back as approved for $9k, with the option to accept or decline.

This is a credit report soft pull, not a hard pull, so not worries about that.

Readers, does the 3x rule hold true for you?

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

The 3x rule applied to me. Asked for a larger increase, but was immediately offered a 3x increase with the decision to accept or decline. Once accepted, the new CL was active within 15 minutes. Thanks for everyone’s responses.

Thanks for this post! I recently received an unsolicited email from Amex stating that they could increase my credit limit on my SPG amex by $1300 (current limit was $10,100). When I clicked the link to go to the form for an increase request, I noticed the $1300 was in a box where you could edit the amount.

Quick Google search led me to this post and I ended up going from $10,100 to $25,000 (I requested $25,000, didn’t do the full 3x).

Anyway, thanks for the info!

Initially approved at $5.5k, the day after my second statement was posted online I requested $15k and was immediately approved.

I have 3 cards with Amex, platinum, Delta Gold and Green corporate card. My Delta was an initial $9k and just asked for $15k today and they approved me after 2 seconds.

$8.2k initial CL, asked for $20k, but was only approved for $13.5k

Ok guys, don’t do this if you don’t want attention from AMEX.

I did this and did not get an instant response – rather I got this:

“Request a Line of Credit Increase

Your request for a line of credit increase has been submitted.

You will receive a written response within 7-10 days. ”

Regretting it now, there will be eyes on my account.

@Steven – good point that it is only something to do if you need it. Amex attention with financial reviews is awful, I went through that, though it seems the main triggers are new card applications or huge spend beyond reported income, I have not seen reports of credit increases triggering FRs but I suppose they could if taken to excess.

You are able to swap credit limits with other cards online. I recently moved $10k from one card to another.

Is the request approved instantly or will a rep has to look over the info first?

Also, is this really just a soft pull? Is this only true for Amex or other banks as well?

@Matt – it was instant, since I requested 10k on this one and they only offered 9k there was just an extra screen for me to accept. Phone is auto, too, have done that before as well.

Each bank is different and some I do not have personal experience, I will research.

Wow, did not know this option existed, and certainly would not have thought it’s a soft pull. Thanks for the tip.

Does this result in a credit pull?

@Michael A – soft pull

Yes, they recently approved me for the Delta Gold card with some odd credit limit amount ($2450 or something strange like that).

I waited until 61 days, and requested via phone (automated system) and was approved for exactly 3x.

I wish they could do a credit line swap. My Amex Hilton Honors card has $8,900 limit while my SPG Personal card only has $3,000. Much rather have it the other way around nowadays…

@Grant – I agree, my highest limits with them have been cards that I have not kept.