Check out our Top Rewards Cards to boost your points earning and travel more!

Barclays credit cards are the most exasperating to research for 2 reasons:

- Cards with the same name often have different versions designated only by their annual fee, such as the Barclaycard ArrivalTM World Mastercard® with its “$89 Annual Fee Card” and “No Annual Fee Card.” Other card issuers have distinct names and branding for each version of their cards.

- Barclays not only offers different and sometimes targeted sign-up bonuses, they also change the ongoing benefits of some cards by offer.

The Priceline Rewards Visa® Card, which I champion as the best cash back card on the market at 5x Priceline earning and 2x everywhere else with no annual fee (2x offer now expired), frequently changes its offers. Points on the dollar wrote that earning had been slashed to 5x/1x.

I dug into this and found 2 current offers (now expired):

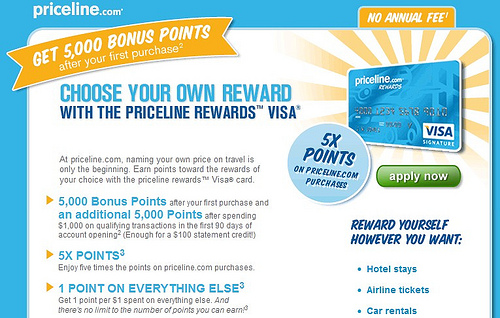

- Earn 5,000 points after first purchase, earning another $5,000 by spending $1,000 in 90 days. Earning is 5x on Priceline but only 1x on everything else. This offer is best for people who want it for Priceline purchases only, so they can pocked the extra $50 sign-up bonus.

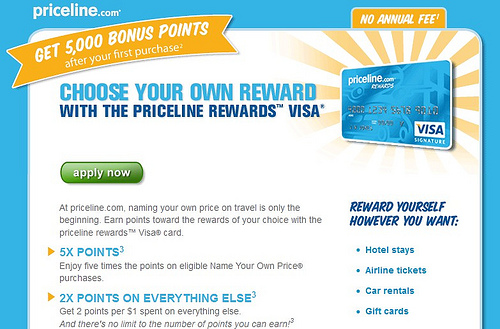

- Earn 5,000 points after first purchase. 1 point/$1 in balance transfers in first 30 days of account opening, maximum 5,000 points. Earning is 5x on Priceline, 2x everywhere else. This is best for people who want the ‘everywhere else’ ongoing cash back.

Offer 1:

Offer 2:

(Disclaimer: I receive referral commission on the cards mentioned in this post.)

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

[…] a small study of Barclaycard’s offerings over the past year and continue to be mystified. I noted in sorting through current Priceline Rewards Visa® Card offers that the two biggest sources of […]

C’mom Baby lets do the twist