Check out our Top Rewards Cards to boost your points earning and travel more!

Updated: sorry, got this wrong in reading the marketing bullets versus the full terms. It is just a 5% bonus at the end of the year, not a bonus on all spend. My mistake. Update 2: after letting it settle for a few days I have made a few further corrections. Not good to post in mistaken excitement when over-traveled and over-tired.

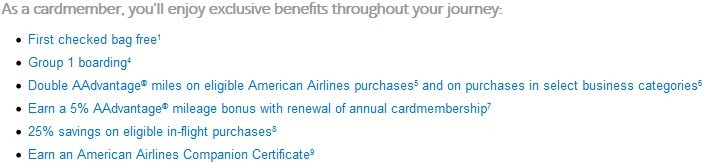

So I was presenting on credit cards at FTU Advanced today along with Daraius from Million Mile Secrets and when he saw a slide draft on the Citi AA Business card (officially the CitiBusiness® / AAdvantage® World MasterCard®). He asked about the 5% annual bonus.

It then dawned on me that I have totally overlooked this benefit. I think the benefit was added sometime in the past year. It makes this card one of the more rewarding and low-hassle on the market.

Here’s how it works:

- 2 miles per dollar on AA purchases

- 1 miles per dollar everywhere else

- 5% annual miles bonus on all eligible spend, provided you pay the annual fee and keep the card open 45 days after renewal

- Annual fee is $95

The official terms are here:

5% AAdvantage® Mileage Bonus for Renewal of Annual Cardmembership

Each cardmembership year, the primary cardmember will earn a 5% American Airlines AAdvantage® mileage bonus on eligible purchases provided that the following conditions are met: (1) the primary cardmember renews the annual cardmembership, and (2) the account remains open for at least 45 days after cardmembership renewal. Eligible purchases exclude balance transfers, fees, cash advances, items returned for credit and finance charges. The 5% AAdvantage® mileage bonus will be calculated as a percentage of the eligible purchases made on the CitiBusiness® / AAdvantage® World MasterCard® during the cardmembership year (each 12 month period prior to the account anniversary date) and will post to the primary cardmember’s AAdvantage® account 6-8 weeks after the above requirements are met.

Eligible Purchases are:

AAdvantage® miles are earned on purchases, except returned goods and services, cash advances, transferred balances, credits, fees and finance charges.

The public offer is a 30,000 miles signup bonus (promoted by some affiliates), however there are typically 50,000 offers available.

Related posts:

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

yikes… this was presented at an FTU ADVANCED?! the ones that ppl pay $249 to go to?

is the knowledge level really that low amoung “expert blogger” presenters at these things where this type of mistake is made??

@james – no, not presented, we were discussing a draft, misread some terms, and got over-excited and pulled the trigger. Things happen. We had fun presentations ranging from b* to Huntington Voice, I think they were well received. The speakers are not compensated for these events, in my case I take time out of my day job to do these because I enjoy the mutual learning from gathering like-minded people, however mistakes get made as much as I endeavor to avoid.

Good job correcting it like you did, Stefan. Everyone has made a mistake with T&C at some point in time, you are not alone! If only that card really would be a 6X – that would be great (for us, not so much for Citi:)

@Charlie – as a blogger told me once, if someone takes time out of their day to insult or criticize me, at least it is a page view. Not that I want to get in the habit of posting erroneous info.

CLUELESS

And people pay to listen to you? Crikey.

@P – yep, I made a mistake reading some of the terms that seemed ambiguous and got excited rather than fully vetting it out, I don’t claim to know everything but I put my neck out mistakes and all as I learn.

Is there a way this can be updated on the boardingarea.com home page? I clicked it once due to the headline (which, if true would be wonderful), read the correction, and then made the mistake of clicking on it again.

Great click bait!

Are you sure that it’s 6x? As I read the phrase 5% bonus, it would mean 1.05x miles on eligible purchases.

this is awesome! I wonder if they will let me convert my 100k signup card to this….

@Ryan – sorry, see the correction.

@Geoff – I am not interested in picking fights among bloggers. We, bloggers and participants, try to all work together and collaborate and share ideas at these events. This one came out wrong. Sorry. (I did just check TPG’s offer page and it is the 30k offer, FrequentMiler 50k, Lucky 50k, Gary I don’t see it. There is the issue of official/public offers and YMMV non-public offers that usually work. Lots of outlets for that debate.)

I wouldn’t trust MMS with any math.

It’s 5%, just like the old 7% bonus on the Chase cards.

And nothing impressive about his ‘hot deals.’ Gary, TPG, and Lucky all show the same one.

I have a high opinion of you and your posts, but associating with MMS is a net negative for your good brand perception.

@Nick – the wording seems ambiguous which is what led me that way but then the later wording in the terms seems more inclined to where the commentors have pointed, I have never kept my card open long enough to test.

Has anybody validated this? The wording seems ambiguous to me, I could see it being just 5% of the 1 mile per dollar spent (i.e. 1.05 miles per dollar including the bonus), not 6x.

5% bonus is not the same as 5X.

If you spend $100 you get 100 miles. At 5% bonus! that makes it 105 miles.

It is 1.05 not 6x. The 5% bonus is on the number of miles accumulated and not an extra 5 points per dollar. It is like the 7% bonus Sapphire Preferred used to offer.

You’re nuts if you think a 5% bonus means a 5x bonus. Just means the cord earns 1.05 miles per $1 spent. Not 6….. Citi could never afford to give out 6 miles per $1 on all business card purchases! I don’t want to be mean, but did you think about this before posting?

If you know anyone who received 5 extra miles per $1 spent when they paid their annual fee, I’ll take back what I said 😉

That would mean citi would give out 50,000 miles for spending $10k. We’ve seen dumber things, but I doubt it!

Shouldn’t that 5% be counted as 0.05*purchase, meaning a total spending of $10k on the card will give you 500 bonus miles? I don’t think it means 5X miles on every dollar spent.

Not sure if you got this correct. 5% doesn’t mean 5x points per dollar, it seems to mean 5% bonus on accrued points over the year. 100k in earned points for 2014 = 5k bonus