Check out our Top Rewards Cards to boost your points earning and travel more!

I have a soft spot for the obscure. I have made a small study of Barclaycard’s offerings over the past year and continue to be mystified. I noted in sorting through current Priceline Rewards Visa® Card offers that the two biggest sources of confusion are:

- Cards with the same name often have different versions designated only by their annual fee, such as the Barclaycard Arrival Plus™ World Elite MasterCard® with its “$89 Annual Fee Card” and “No Annual Fee Card.” Other card issuers have distinct names and branding for each version of their cards.

- Barclays not only offers different and sometimes targeted sign-up bonuses, they also change the ongoing benefits of some cards by offer.

Two more should be added:

- The fine print on some cards or some offers notes that applications may be approved for lesser versions such as Platinum, sometimes but not always with lesser bonuses, if declined for the desired version.

- Sign-up bonuses often include a balance transfer component with fees that can eat you alive.

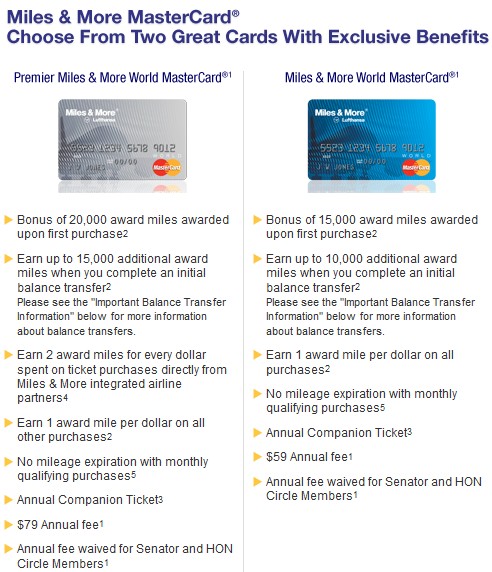

Next post will look into the thicket of offers on the Lufthansa Miles & More MasterCard®, but the starting point is where to look for Barclays offers?

Generally the worst place is the Barclaycard website, which lists the minimum offers, often balance transfer heavy.

The best place usually is the website of the company branded on the card. Go to Priceline for the best Priceline offer, Lufthansa for the best Lufthansa offer, etc. Barlays sometimes sends targeted offers but these generally match the public offers on these websites. For instance the (now expired) 50,000 mile offer for Lufthansa is displayed on the Lufthansa US homepage.

On the Barclaycard homepage is the standard 20k offer:

(Disclaimer: I receive referral commissions for some of the offers on these cards.)

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

Here’s another weird one: My wife and I applied at the same time for our SECOND US cards. We both have existing US cards open from a couple years ago. We both were instantly approved. Wifes lower credit score resulted in a HIGHER INTEREST RATE for her, but the cards are the SAME and the bonus was the same (already posted). It’s not relevant since we won’t be paying any interest anyway, but it is curious!

Their customer service is hit or miss. In March, my husband applied for US Airways card and Frontier Card on the same day and one went to pending. He called in and CSR offered to move credit around so he could get both cards.

Barclays has some attractive offers but their customer service is a work in progress.

Barclay’s won’t be decoded by me. They declined me the other day on a second US Air card (Chase instantly approved me on Sapphire a few weeks before and my credit is excellent).

I thought about doing the reconsoderation stuff, but I said f*** it and cancelled my Barclay NFL card. It was only six months old, so it won’t hurt my average card age.

I’ll get rid of the US Air card soon. Of course the US Air / Barclay relationship will be gone soon anyway.

@Carl P – my experience, too, is not worth the effort to try recon for them.