Check out our Top Rewards Cards to boost your points earning and travel more!

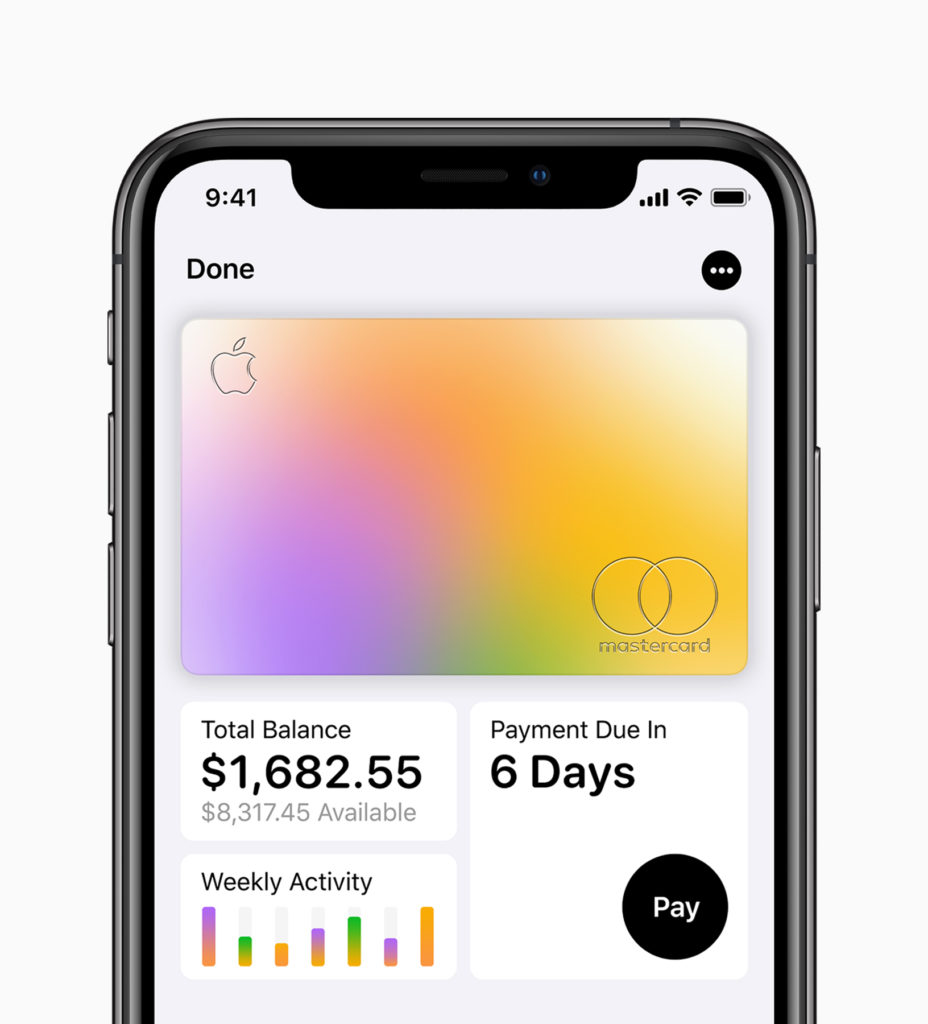

Apple Card has just been announced. The card earns ‘Daily Cash’:

- 3% cash back on Apple purchases

- 2% cash back on Apple Pay purchases

- 1% cash back everywhere else

Of note:

- Cash back rewards post same-day to Apple Pay balance

- No annual fee, foreign transaction fee, not even late fees or over-the-limit fees, and interest rates are advertised to be competitive

Sign-ups will start this summer via the Wallet app.

My Take on the Apple Card

This card will have mass market traction because it is Apple and because it is fairly simple if you are comfortable using Apple Pay. The card looks cool, as we expect from Apple. Same-day rewards are a big plus as we are country of people with one foot always in the payday loan shop.

However, there isn’t much new to savvy credit card users. It will appeal to the people who got the Chase Sapphire Reserve because it is the ‘it’ card and then think they are hot stuff on 1.5 cents/point redemptions on travel, without knowing anything about the airline and hotel transfer partners.

In short, you have to be tech-savvy and tech-minded enough to use Apple Pay everywhere, but not motivated enough to find a better card or two.

This is the card I expected, not the card I hoped for from Apple’s partnership with Goldman Sachs.

Alternate cards to consider:

- Citi Double Cash – 2% cash back everywhere

- Fidelity Rewards Visa Signature – 2% cash back everywhere when deposited to a Fidelity investment account

- US Bank Altitude – 3x on mobile payments including Apple Pay, but a $400 annual that comes with some travel benefits

- Chase Freedom Unlimited – 1.5x everywhere (currently the first year is 3x) that can be paired with premium Ultimate Rewards cards like the Chase Sapphire Preferred and Chase Sapphire Reserve

The Apple Card is an everyday card candidate for Apple users that like Apple Pay. It won’t be joining my stable of cards.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

As someone who carries other 2% cards, the only slight appeal is 3% on Apple purchases, and those purchases are not significant. I guess it’s ok for diversification on 2% purchases, but it’s not stellar.

As usual with any Apple products/gadgets: over-hyped and over-priced and only benefits Apple (a Tax dodging criminal company)!

https://runt-of-the-web.com/apple-announces-apple-brick