Check out our Top Rewards Cards to boost your points earning and travel more!

Bummed about revenue-based earning on American Airlines flights? There looks to be a partial workaround.

At Frequent Traveler University in Washington, DC this weekend, a participant who wishes to be anonymous (DC has lots of those) found that his ticket to and from the event posted base miles at 50% of mileage flown rather than revenue calculation.

He is Executive Platinum and also got his elite bonus, which posted as a multiple of base miles. The multiple was 2.2, the difference between 5x non-elite and 11x Elite Platinum. It took him a fair amount digging to suss out this calculation.

On this short flight he earned less than he would have under revenue earning. On a cheap, long-distance flight he likely would have earned more.

Here is his note, which he agreed that I publish in full. It has been lightly edited for clarity.

Disclaimer: as he notes below, this is early days and we do not yet know if this applies to all AA routes or only specific routes. In the comments, Jig explains current theories about this.

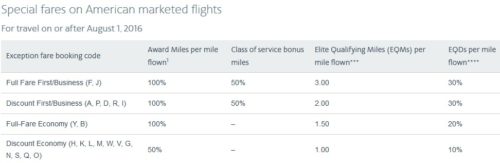

My flight from LGA-DCA was booked using Citi ThankYou Points. The fare paid was about $110, so with my Executive Platinum status, I expected to receive well over 1,000 miles. However, when the miles posted, I noticed that they were issued in accordance with AA’s “Special Fares” chart:

This would indicate that some/all flights booked through Citi TYP and possibly other bank programs are not subject to the standard accrual policy.

Here’s a breakdown of the miles I earned for LGA-DCA:

- EQMs: 500 (EQM minimum as expected)

- Base Miles: 107 (50% of 214 flown miles for Discount Economy fare classes)

- Bonus Miles: 129 (needed to arrive at figure below)

- Total Award Miles: 236 (Base miles x 2.2 for an Executive Platinum). This is the multiple from 5x (non-elite) to 11x (Executive Platinum)

As this example shows, a short-haul trip will yield a surprisingly low number of miles. Conversely, on medium to long-haul flights, the results are quite different.

His return flight posted the same way.

Here’s a predicted transcontinental example (JFK-LAX) for an Executive Platinum at an approximate break-even fare for non-elites of $247 one-way [ignoring taxes]:

- EQMs: 2,475

- Base Miles: 1,238

- Bonus Miles (2.2x of earned base miles): 1,484

- Total Award Miles: 2,722

Here’s how JFK-LAX would presumably look for a non-Elite customer:

- EQMs: 2,475

- Base Miles: 1,238

- Bonus Miles: 0

- Total Award Miles: 1,238

Here’s a predicted transpacific example from the East Coast (LGA-DFW-HKG) for an Executive Platinum an approximate break-even fare for non-elites of $951 one-way [ignoring taxes]:

- EQMs: 9,512

- Base Miles: 4,756

- Bonus Miles (2.2x of earned base miles): 5,707

- Total Award Miles: 10,463

Here’s how LGA-DFW-HKG would look for a non-elite customer:

- EQMs: 9,512

- Base Miles: 4,756

- Bonus Miles: 0

- Total Award Miles: 4,756

One major caveat is that there is insufficient data to conclude that this alternate distance-based calculation is utilized on all routes.

As an aside, in 2017, these flights will earn EQDs as a percent of total mileage flown, according to the fare class rates on the Special Fares chart, which range 10%-30%.

Takeaway: when buying AA tickets, consider if you will be better off purchasing through a traditional channel that will earn purely revenue-based, or a channel like Citi ThankYou that uses a hybrid Special Fares approach.

Readers, what have been your early experiences with tickets from Citi, Chase, US Bank, etc?

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

[…] couple of weeks ago, Rapid Travel Chai posted about a flyer who earned distanced based redeemable mileage by booking flights through though…. I wondered if there were other ways to still earn distance based redeemable mileage and discovered […]

[…] There is some discussion going on about how you might still be able to get your American Airlines flights credited under the old rules […]

[…] Want an AA Revenue-Earning Workaround? Here’s a Partial One – Booking with ThankYou points may be a way to earn more miles on your AA flights. […]

I mean why are you alerting AA to this loophole we Delta flyers knew exusted.

@Rich – like the rest of revenue-based earning, some tickets earn more, some tickets earn less than before. This is a published award chart for these types of agencies and AA went to the trouble to program this earning methodology. It hardly is a loophole that AA will suddenly wake up to its existence and close down. It can be useful for a small set of educated customers to strategically decide when to use such agencies or not.

Don’t spoil it for those of us who knew this already from Delta. One post is enough. Hint, hint.

I ticketed a SEA-PHX-ONT flight after Aug 1st using TYP. I’m a Platinum. The fare including tax was $105 (base fare $76) so I would have expected earning just over 600 miles. However, I earned 1/2 of base miles + 60% bonus for platinum (for a total take of 1148 miles). A far cry from the 3200 or so miles I got from the same trip a week earlier but at least better than 600 miles.

[…] { googletag.display('div-gpt-ad-14'); }); I found this interesting: http://rapidtravelchai.boardingarea….venue-earning/ That means as EXP doing a discount biz (I Class) run booked with TYP, doesn't that mean you earn […]

Thanks, Stefan. So the appearance (or not) of the fare breakdown on aa.com still seems like a possible tipoff as to crediting method.

[…] Want an AA Revenue-Earning Workaround? Here’s a Partial One […]

I can confirm that my miles were calculated the same for a ticket purchased with ThankYou points for my BWI-PHX and PHX-LAS flights. I was confused about the calculation, but it now makes sense.

There haven been TYP booked experiences for both regular rev based and then special fare chart based earning posted on FT. Some have stated that there are particular routes that have been bought in bulk by the Connexions agency which administers the TYP travel, and other routes are regular rev based earning. Some have also speculated that if you can view your fare breakdown when looking up your itinerary on aa.com, you will earn regular rev based. Wonder if the DC reader source was able to see his fare breakdown on the website before the flight?

@Jig – I believe my source is active on the FT discussions you reference so will get to the bottom of it. I put in the disclaimer that it is not yet known if all routes or what routes, I suppose I should have put it more prominently at the top.

@Jig – contributor says, “I do not believe the cost of the ticket appeared on my AA itinerary when I checked it online before the trip.”

Interesting. Thanks.