Check out our Top Rewards Cards to boost your points earning and travel more!

US Bank has some greatly rewarding credit cards and a hyper aggressive fraud prevention department that tries to prevent obtaining those rewards.

The Club Carlson cards, personal and business, earns 5x (10x at Club Carlson hotels) and have a free last night award on benefits that turns award hotel stays into buy one, get one.

The FlexPerks Travel Rewards Visa personal card earn 3x on charity, 2x on mobile phone service and 2x on whichever of airline, gas or grocery is highest spend in a month. The Amex version adds in 2x on dining. The business Visa version is 2x on mobile phone service and 2x on whichever of airline, gas or office supplies is highest in a month. Both personal cards have annual caps of $120k spend, after which all spend earns 1 points per $2 spend, while the business card is not capped.

I have both Club Carlson cards and both FlexPerks Visas, and am planning to try for the FlexPerks Amex.

I would love to use these cards more, however US Bank fraud prevention is maddening.

Some of the things US Bank does not like:

- People who make purchases over a few hundred, really not liking $500 or more

- People who make repeated purchases

- People who make even hundred purchases like $500

- People who have regular middle of the night charges (Amex Serve, now treated as cash advance anyway)

- People who shop at Target (“because Target was hacked”)

- People who live in New Jersey (“you are in a high fraud area”)

- People who commute to another state (“your address is in New Jersey, these purchases are in New York?”)

- People who travel (“it looks like you are traveling” with a travel rewards card)

Interestingly, I have had much less trouble with online transactions than in person, important for those who do heavy online charity like Kiva.

What not to do:

- Don’t bother calling in to pre-authorize transactions. Hold times are typically long, regularly 10+ minutes, longest I have had is 32 minutes. Each time the agent dutifully notes the information, tells me I shouldn’t have a problem, and then I have a problem.

- Don’t expect a call, they never call to ask you to verify transactions.

- Don’t use the website, it doesn’t even show you are shut down.

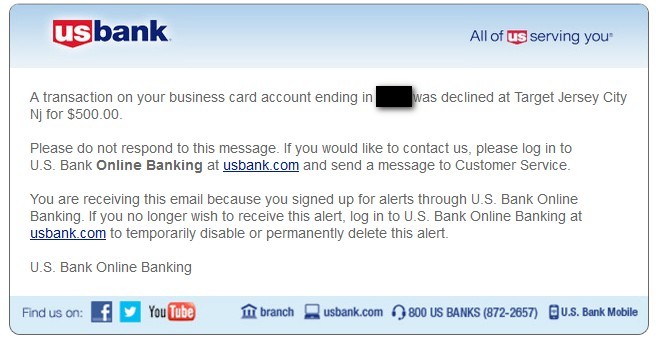

- Don’t bother setting up declined transaction and suspicious transaction notifications. The text messages and emails, unlike other banks, do not have any way to reply to clear the transaction. The emails take some time to arrive and suggest sending a message to customer service which could take days.

- Don’t bother the US Bank app either, there is no functionality to unfreeze accounts.

What to do:

- Try to have a regular pattern of purchases large and small (which I have not been good at doing).

- Try the Club Carlson over the FlexPerks cards (“We know those have higher spend”).

- Do not have even hundred transactions, so for $1,000 do a split transaction like $383.47 and $616.53.

- When transactions are declined, call Fraud Prevention at either 866-821-8411 or 800-260-8469, both were told to me by agents claiming these connect faster, though my experience is mixed.

- When they keep freezing your cards, they have a way to transfer to a fraud supervisor who asks a lot of questions from info they have from your credit report and transactions do actually go through after this (I am not sure if this is long-lasting as I just did this on Sunday).

- Have non-US Bank cards with you to keep cashiers from loosing their temper.

Readers, have you had fraud prevention issues with US Bank or is this just a New Jersey address thing? Please share your experiences.

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

[…] FrequentMiler walks through How to setup credit fraud alerts by text or email. Most of these work well, except US Bank, which notifies you but provides no way to lift the block without calling in, and their hold times are atrocious, I have had more than 30 minutes at times. See my US Bank fraud prevention tips. […]

I’ve had tons of problems with them. So much so that I’ve stopped using the cards for MS because I’d have to spend 15 minutes on the phone with them every time even though I’d love to accrue more CC points.

Wife & I both received new replacement Club Carlson about a month ago due to fraud. That’s when every load for redbird & Amex for Target stated being declined. It got maddening on hold and different reps gave conflicting info. It was always the computer needs to learn your spending habits. Finally had a supervisor call me and loosened up the triggers. We started doing loads in the high $900’s w/ no problem. I got brave and did $1K, $1K & $500 during one vist to Target and they all went through. Hopefully no more issue here in Jersey.

I give up trying to make any large purchases with my Flexperks card. I have heard many of the things you listed like “even number looks suspicious”. I stick to small and online purchases only now.

I used to have more problems with this but have pretty clearly built a profile there since I note do multiple thousand dollar grocery transactions in a single day without a peep from their fraud people. When I got a decline I would always wait for the email, and then call the listed number, and would almost always be able to do an automated system to verify my transactions. YMMV I guess!

Had this issue when attempting to load $2500 on RedBird with my FlexPerks card the first time. Completed the transaction with another card, cleared the transaction the next day, and then haven’t had a problem since then. Have completed 3x $2500 loads to RedBird in the past month and a half with FlexPerks without any issue. These Targets are categorized as grocery so I get 2x, not bad.

I live in MN and used to bank with US Bank. It took me about 4 phone calls just to make a purchase with BA on my US Bank debit card. it wasn’t even terribly high, maybe a few hundred dollars.

I was having no problems (I live in Chicago and have most of the cards you were describing), until there was a data breach and they replaced my Flex perks card. Then it became maddening. I finally got set up with the automatic suspicious activity texts. However, mine has a number to call in to verify transactions. Have received a couple of texts in a month and the call ins were easy. Number is 800-379-8461.

I live in WV and do lots of charges in VA and MD. Also some Colorado trips. I do repeated purchases (if weekly nights at the same hotel count). So far I’ve never been affected by fraud detection on Club Carlson or FlexPerks cards.

Not a lot of even hundred or Target purchases.

@rapidtravelchai

lol used to broker mortgages through USB… pretty similar hoop jumping.

target loads got blocked if more than 1 per day.

had fraud dept on phone as i approached target checkout.

all good in the end.

USB fraud red said large, round ($1000) purchases are a red flag.

tried 2 odd amount target swipes consecutively… no dice on 2nd swipe. trusty ink bold came through.

hope im able to churn the carlson personal after keeping it closed for 1 yr.