Check out our Top Rewards Cards to boost your points earning and travel more!

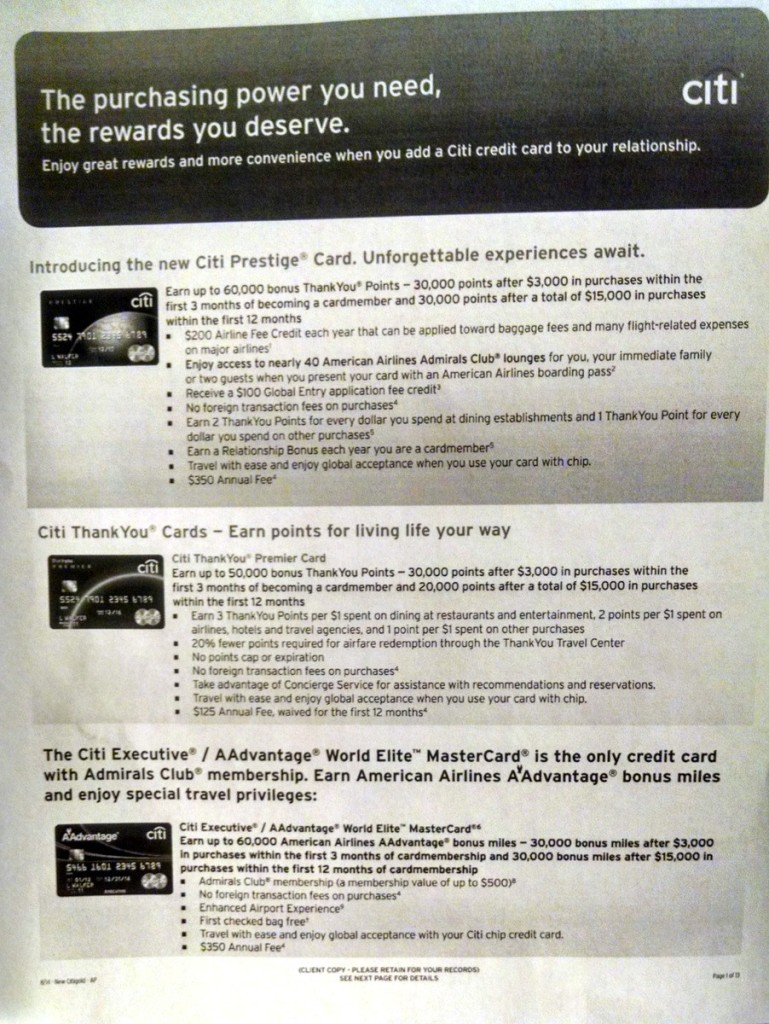

Banks seem to want customers to visit branches which was not my assumption. Chase continues to have an Ink Plus 70k in-branch offer (some people get targeted for the same offer by mail). Citi has a Prestige 60k offer which may be limited to holders of Citigold checking accounts.

I had not transacted business in a bank branch for years other than occasional need for new or small denomination bills for travel.

Last week I went to Chase and Citi for their offers, and also Bank of America to open a checking account to boost to $120 the easy annual returns on my 3 (and counting) Better Balance Rewards cards from card conversions.

Each of these banks is now has one overwhelmed person on a podium who directs traffic and also goes into detail with customers. Get stuck with a rambler in front of you and it can be quite some time before this gatekeeper passes you on to the proper person. To open an account you then need to sit down with someone in an office rather than do a quick form and hand to a teller. Presumably this is to build a ‘relationship’ and to cross-sell, though none did much of that.

Chase I timed pretty well. One customer was wrapping up with the sole small business banker. The application process took about 20 minutes for him and the manager to sort out because I did not have a business checking account with them and there was some system issue because prior Chase small business credit cards had been tied to my SSN rather than EIN. My Experian was frozen so when I left the brach I called Chase, they agreed to pull TransUnion and denied me for too many recent accounts. Same thing on a length recon call.

BofA checking took several trips and different branches, always saying it would be ‘at least 15-20 minutes.’ The reason I was applying with them in branch was my Experian report was frozen and the online account opening application failed at indentity verification. I was told to go to a branch with my ID. At the branch they said they can do nothing about online applications so started a new application and the branch manager agreed to honor the $150 online offer I found. Total process about 45 minutes.

Then there is the ongoing Citi saga. I went to a branch and waited it out through a full New Jersey experience, with a middle-aged women droning on and on about credit card late fees the branch could do nothing about, interspersed with her life story and frequent references to her dialysis treatment. Like other branches, the tellers can do nothing with new accounts and there was only one banker.

When I got to the Citi banker, she really tried to help, did the form on her system, I signed off, and she said it would be faxed in. Yes, faxed. Two days later I had heard nothing, Citi had not received any application, and I had to go back to the branch before leaving the country on business for two weeks. I’ll spare all the details until I have a clear picture. In fairness it is complicated by my lack of Citigold banking relationship.

Whew. I like doing things online much better!

Check Out Our: Top Rewards Cards ¦ Newsletter ¦ Twitter ¦ Facebook ¦ Instagram

I saw in an April post you had that Experian freeze for Chase cards was dead. Looks like although you didn’t get approved on this one, at least the Chase Experian freeze experience is still alive? I’m curious as I would like to add the freeze for an upcoming app-o-rama that will consist of Chase personal/business cards.

@Matt – I can only vouch for my experience that since then I have not had any success with the freeze for Chase personal cards, only now this one business card. Dan’s Deals say, as usual, it is possible with lots of HUCA, but there are times where there seems more bravado than substance. The freeze is also good for avoiding inadvertent hard pulls, such as a checking account you think will be a soft pull but the bank pulls hard, or starting mobile phone service or such like.

… a full New Jersey experience

smittytabb beat me to it 🙂

Full New Jersey experience. LMAO

Thank you for your reply! Your blog is so different from the others hence why I love reading yours. Congrats on the 60k!

@Joey – in NJ where I reside Amex, BofA, Chase, and Citi all pull Experian. Lots of inquiries on one is not good. Amex and Citi never agree to pull a different one than their original attempt. BofA always agrees. Chase personal used to, latetly I am having no success even with lots of HUCA except Chase business has agreed to pull other. Previously it was useful for Chase, now it is less utility to me.

Good news, after some calling around, got approved for the Prestige 60k. Details tomorrow.

Wow that is a lot of hassle! Is the offer enough for you to upgrade your account to Citigold (even for a month) so you can get the 60k bonus offering?

BTW, why did you freeze your Experian acct? I know it’s a good idea to freeze ARS/IDA accts when applying for USBank credit cards but not sure the pros are for freezing the Experian one (unless fraud is involved?)

I hope everything works out!